Of many smaller businesses you prefer organization investment often to assist them to get off the ground or to fulfil the possible. There are a few funds options you could potentially pick, although viability of each and every will depend upon the requirements of your online business as well as newest issues.

In the event the requires are small-label, a bridging loan having company is a choice worth taking into consideration. Here, i view everything you need to know about connecting finance in the united kingdom.

What is actually a bridging mortgage having business?

A business bridging financing is a kind of industrial financing you to allows you to borrow funds over a shorter time period than simply an everyday financial loan, regardless if tend to at the a higher rate of interest.

Bridging funds are typically taken out by the businesses that you need brief name financial support – you could, for example, features committed to your own stock or possessions and have a space between fee shedding owed and one source of capital becoming readily available for your requirements.

Ultimately, they are a beneficial bridge’ in order to a very long lasting source of money to possess a business, whether that is that loan or income out-of sales.

Bridging finance can usually be create seemingly easily and will feel easier to arrange than other different fund.

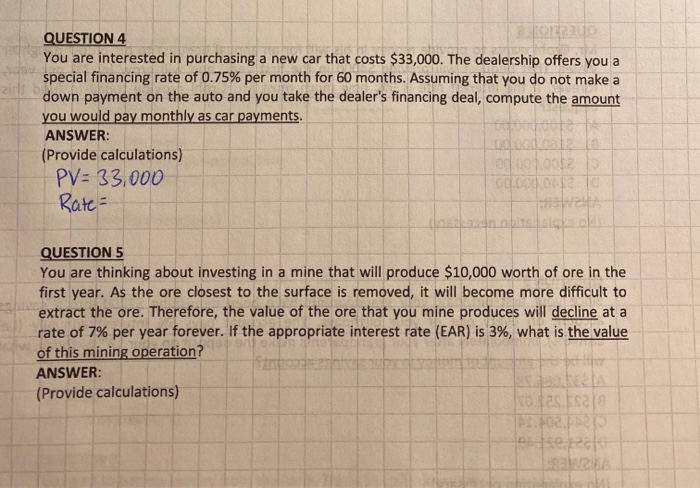

Why does a connecting loan works?

A bridging loan to own a United kingdom business necessitates the borrower (in this case, your online business) to hold property due to the fact sureity against the loan. Usually, so it security could be a property or property, but some businesses may be able to play with most other quality value property rather.

A lender will give to a certain portion of new value of the safety you devote right up. It is known as the financing to value’ proportion or LTV. The maximum LTV offered by most lenders are 75%.

The financial institution will costs focus to the loan, the speed where is founded on the amount borrowed and you may simply how much risk the financial institution believes its using up because of the offering the financing. Which quantity of risk can often be based on your credit rating while the newest activities of your organization – therefore startups otherwise companies that have had financial trouble in the past find it tough to get borrowing otherwise might possibly be billed a higher rate of interest into anything they borrow.

Normally, a complete amount along with attention is actually repayable at the end of the mortgage months, though some loan providers will take very-called appeal only costs each month. There are even month-to-month connecting financing, which happen to be said lower than.

Exactly what can a business connecting mortgage be used for?

A corporate connecting financing really can be used getting things. But because they’re brief-label loans and can be more expensive than many other forms of funding, they are generally useful for biggest requests like property. A business must have fun with a connecting loan to shelter powering costs or purchase most stock it have a tendency to afterwards offer to customers.

Just as in really types of credit, the cost of a business bridging loan may differ and you can would depend towards the many products, including the measurements of the mortgage while the day more than and therefore it would be repaid. However, financial pricing tend to be more than to other credit.

A routine lender will charge between 0.5 to just one% four weeks. They may and charge plan, valuation or other management charge. It’s very important to understand the varieties of connecting mortgage available, as well as how costs is determined for every.

What forms of team bridging money are there?

- Employed – Less than a held connecting loan design, the lender retains the attention into the full length of one’s financing, making it simply repaid on history week since a good unmarried lump sum payment. Effortlessly, an entire matter that you’re going to shell out are computed right as the mortgage was applied for. This may work-out higher priced total but can getting attractive because function you will not face monthly costs.

- Rolled up – Rolled up bridge funding is really equivalent. However,, under that it model, notice is extra per month and so develops everytime. But not, complete that is cheaper than opting for an organised interest financing.

- Monthly – A month-to-month connecting loan 's the cheapest and you can ideal choice, but may never be right for the businesses. Right here, attention repayments try paid per month, definition you find yourself using quicker during the period of the fresh new mortgage. But, in the place of additional one or two possibilities, as a result youre responsible for monthly payments.

Just how long does a connecting loan history?

A bridging mortgage is designed to feel a preliminary-label brand of company resource. Capable past out of anything from one month to three years, but most loan providers won’t bring connecting loans that will be longer than 12-eighteen months.

Exactly what are the advantages and disadvantages away from a connecting financing?

The advantage of a business bridge mortgage because the a questionnaire away from capital for your business is the fact it may be developed quickly. A link financing is also tend to much more flexible than other brief organization capital alternatives, because the consumers possess some control of installment possibilities.

However, connecting financing also are typically more expensive than expanded-name solutions (though increased competition was driving pricing down). Also, because they’re unregulated, connecting funds can sometimes come with many hidden charge.

So what can be used while the secure deposit against company bridging finance?

Extremely enterprises – like most personal borrowers – fool around with property otherwise homes as the safeguards when taking aside a connecting mortgage in the uk. Although not, that does not mean you otherwise your company should very own a https://paydayloanalabama.com/gurley/ property to view connecting money.

You may want to play with devices, the value of delinquent invoices or even the equity kept for the your company as safety. It needs to be detailed, but not, that the number you could acquire lies in the value of the protection make use of, this is exactly why high priced items like assets try preferable.

Which are the alternatives in order to connecting financing?

You can find however of numerous options to help you connecting fund for the team, depending on what you would like this new funding to possess.

For those who very own a property outright that you will be playing with due to the fact security against a connection financing, you could potentially as an alternative take-out a professional mortgage. This might work out minimal however, tie your into a good longer arrangement that have a lender.

Additional options to possess small-title borrowing were charge investment or innovation investment. You could also ask your financial in the organizing a shorter-label organization loan.

Where to find a corporate connecting financing that have Bionic

From the Bionic, our team regarding team fund advantages know exactly where to find best unit to greatly help your organization go its likely.

If you decide you to a bridging loan is for your, we could use our smart technical to complement your towards best deals on the market. We could take-all the stress off organizing and handling the loan while keeping you informed regarding the advances of one’s app.

The we need from you to begin is your company label and postcode, therefore we normally show you every step of the ways.