Charlene Rhinehart try an excellent CPA , CFE, settee out-of an enthusiastic Illinois CPA Society panel, and it has a qualification during the bookkeeping and you will money from DePaul School.

What’s a no-Appraisal Financing?

A zero-assessment loan was home financing that doesn’t wanted a professional estimate of your own security property’s market worthy of, understood inside home parlance just like the an assessment. No-assessment mortgage loans is barely available to borrowers buying home.

And no-appraisal loans, the risk to help you a lending company is actually high while there is zero impartial testing of property’s value that lender is actually money. In the event the a homeowner defaults towards mortgage, also it looks like the home is really worth less than the loan, the lending company wouldn’t be capable recover the full worthy of of one’s financing immediately after selling the home.

Secret Takeaways

- A no-appraisal loan is actually a mortgage that doesn’t need an expert imagine of your own property’s worthy of, titled an appraisal.

- No-assessment loans are often scarcely available to individuals purchasing homes.

- No-appraisal financing can be risky for loan providers given that there isn’t any impartial evaluation of the home, and this functions as security on mortgage.

- In place of an appraisal, the financial institution is lose money should your homeowner defaults into mortgage and also the property is worthy of lower than the loan.

Just how a no-Assessment Mortgage Works

A zero-assessment financing are able to use different ways away from determining an excellent residence’s well worth for the true purpose of defining how much money so you can lend, otherwise may possibly not require top-notch research of the house’s latest market price, simply information on the newest borrower’s mortgage harmony and you may cash.

No-assessment funds become designed for dealers who’re changing otherwise bundling the house such that produces a great latest valuation invalid or moot. They also tends to be accessible to investors who will be installing even more compared to the standard 20% down payment of your own cost of the home. Yet not, these two is special things that don’t affect the typical client.

A no-appraisal refinance mortgage is also known as a zero-appraisal financial, however, a first-go out home loan and you can a mortgage refinance mode in another way, as well as the things about giving each of them no appraisal differ.

On normal home visitors, a no-appraisal mortgage is highly strange towards an initial home loan, but it’s more common whenever a home loan has been refinanced.

No-Assessment Funds vs. No-Appraisal Refinances

Extremely very first mortgage loans require appraisals, but a mortgage refinance, titled a great refi, might not you desire an appraisal, based where in actuality the first-mortgage originates. A home loan re-finance is financing provided by way of a home loan company one pays the initial financial, substitution the initial financial. This new resident produces monthly or biweekly costs toward refinanced mortgage exactly as it did to the fresh home loan.

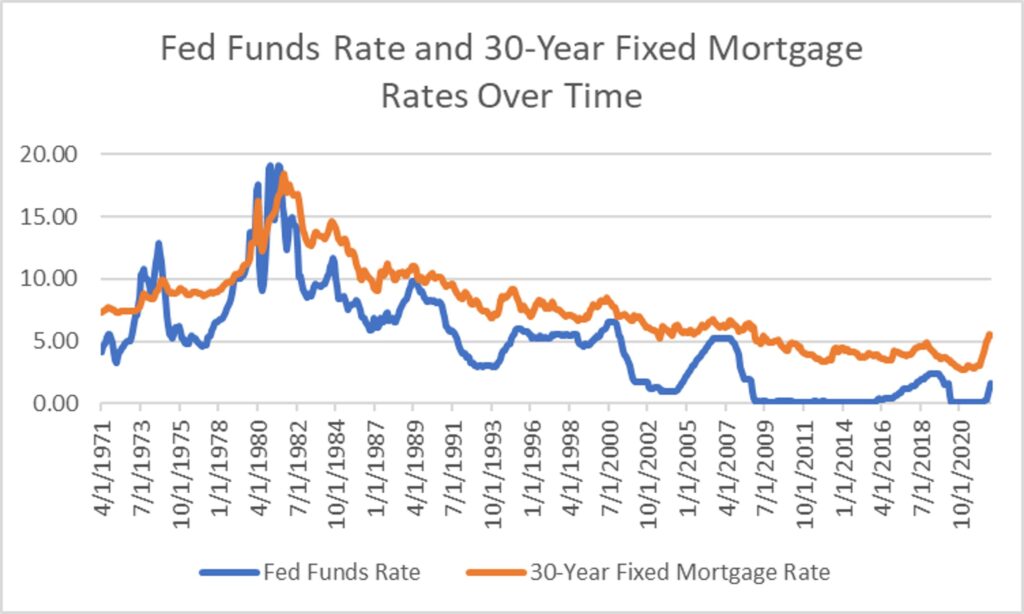

Generally, property owners re-finance their mortgages to alter brand new terms on the loan. Such as, if financial prices has actually decrease somewhat, a debtor might refinance their mortgage from the lower price in order to slow down the monthly payment or shorten the size of the loan.

Both, a good homeowner’s house collateral increases due to a boost in regional possessions philosophy. Consequently, this new borrower you will choose for a profit-away re-finance https://www.cashadvancecompass.com/payday-loans-ia/portland/, which is if the loan is refinanced, and area of the collateral or enhanced well worth was drawn once the dollars during the financing closure.

Almost every other motives having refinancing through the desire to add otherwise lose yet another group on new mortgage or perhaps to convert an adjustable-rate mortgage (ARM) into the a fixed-rates mortgage.

Real-Life Samples of No-Assessment Refinances

Certain federal apps provide zero-appraisal mortgage loans or refis. In the 2017, the government-backed lenders Fannie mae and you can Freddie Mac computer began offering appraisal waivers in a few discover circumstances, both for re-finance funds and unique household pick finance.

Government refis assist make certain people do not standard to your first home loan and will stay static in their houses, providing balances into area and the regional housing market. Therefore, no-appraisal refinance ventures usually work at certain higher-risk types of property owners who have been not offered a unique no-assessment mortgage.

The explanation out of an appraisal is the fact what is very important to own lenders-even if the financial is the You.S. government-so you can lend a correct amount of money to pay for good property therefore the resident does not get in big trouble which have payments while the bank could recover the worth of the borrowed funds in the event that the house were ended up selling.

But not, since the purpose of a no-appraisal refi will be to simplicity the latest homeowner’s conditions and you may costs, the true value of the property by way of an appraisal isnt since the associated.

Is a loan Be Recognized In the place of an assessment?

Usually, a primary home mortgage demands an appraisal of the house. But not, a zero-appraisal loan is an option when refinancing an existing financial mortgage.

When Would a loan provider Not want an appraisal?

Whether your mortgage try federally insured, the financial institution are protected from default exposure. This is why, some federal programs promote zero-assessment mortgages or refis, as well as Federal national mortgage association and you can Freddie Mac computer. Also, the latest Federal Housing Administration (FHA) additionally the You Agencies out of Agriculture (USDA) keeps comparable apps.

What exactly are Appraisal Can cost you?

Appraisal prices are the new charge recharged for inspecting a home in order to determine the proper worth. Property could have problems, negatively impacting this new appraisal’s worth otherwise renovations, boosting the significance. The home proportions and place can also impact the assessment, that will effortlessly may include $500 so you can $1,000.

The bottom line

A no-assessment loan is actually a home loan that doesn’t wanted a professional imagine of your property’s worth and is maybe not considering apparently to consumers to acquire home. Mortgage brokers possess yet another chance and no-assessment finance simply because they may not have a precise and you will most recent market value of the house used just like the equity towards the mortgage.

Even in the event most first mortgage fund wanted an assessment, there are some era in which an effective refinancing out-of an existing mortgage will most likely not you prefer an appraisal. However, there is certainly requirements such as for example an appraisal is actually done whenever the first home loan are longer.