step one. Traditional Mortgage / Fixed Rates Mortgage

Traditional fund are not secured or covered because of the government. They might be fixed when it comes (ten, fifteen, 20, 29 & 40 12 months) and you may price. There have been two version of traditional fund; conforming and you may non-conforming fund. Compliant money fall into the limit limits out of place of the government we.age. less than throughout the $700,000. Things above the maximum could be felt a Jumbo Loan and thus, non-compliant having authorities restrictions. These types of normally have high costs and want so much more hoops to plunge compliment of having qualification.

Old-fashioned funds are ideal for people with a beneficial credit rating, steady money, as well as minimum 3% of your own down-payment. You will likely spend financial insurance coverage if the downpayment is actually below 20%.

2. Bodies Insured Fund

Around three regulators companies let customers with mortgages: The new Federal Casing Management (FHA Financing), the U.S. Service away from Farming (USDA Fund) in addition to You.S. Agencies away from Veterans Activities (Virtual assistant Loans).

FHA Money is as absolutely nothing since the step three.5% down based on credit. FHA Money wanted one or two financial superior, one paid down initial while the other paid off annually which have less than ten% down-payment. Private home loan insurance (PMI) needs if you don’t has actually at the least 20% collateral in your home.

Va Finance are offered in order to U.S. Military (productive responsibility and you may experts) in addition to their families. They won’t wanted a down payment otherwise PMI however, a funding payment was billed since a percentage of mortgage.

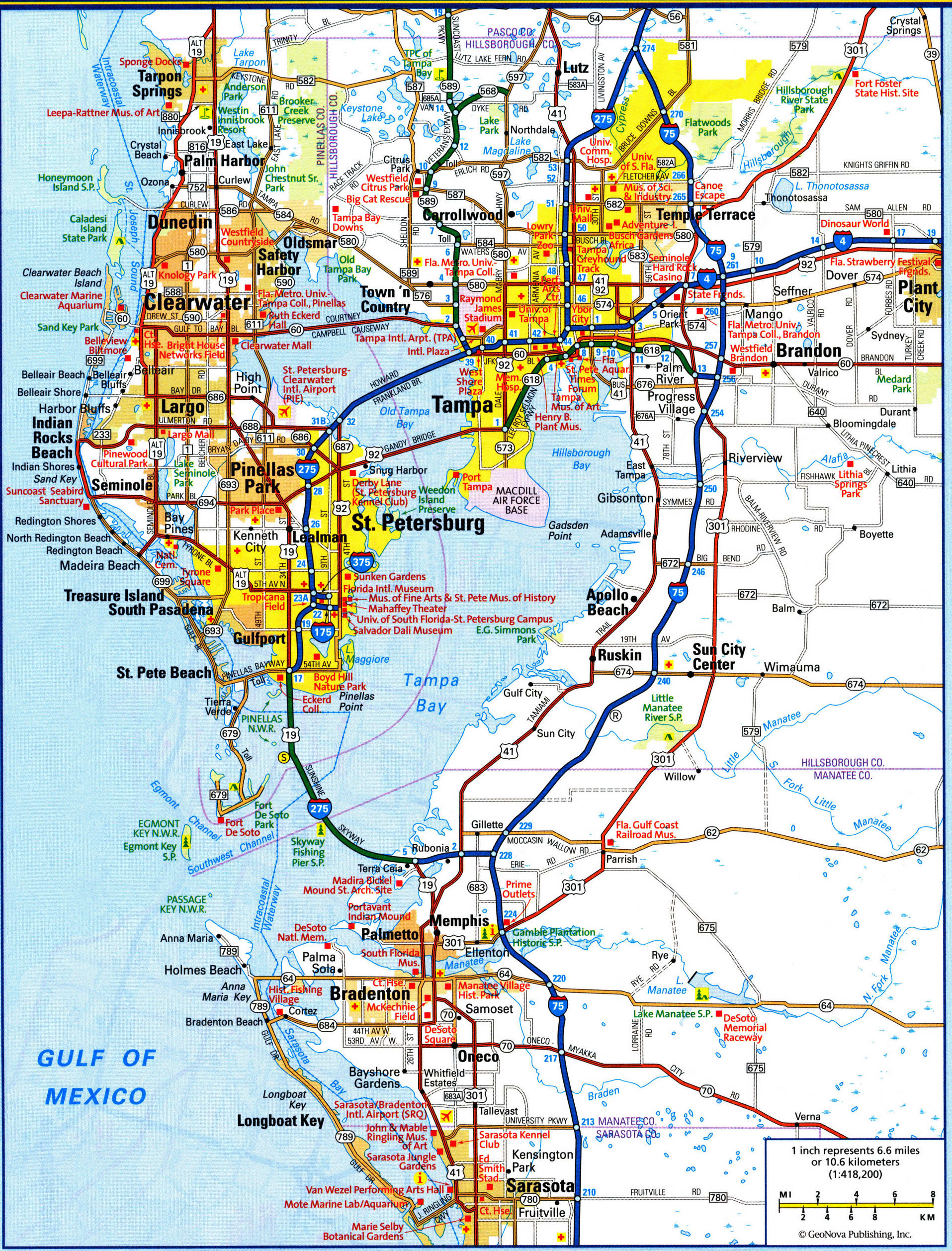

USDA Money let people residing rural, USDA-qualified components safer home financing. Dependent on money level, some USDA financing do not require an advance payment. Upfront financial insurance policy is 1% which have a 0.35% yearly commission paid in monthly installments.

step 3. Changeable Rate Mortgages (ARMs)

A variable price mortgage features a changing rate of interest which is dependent on market criteria and financial conditions. Of many Sleeve affairs have a predetermined speed into the first few decades after that reset to variable prices, possibly with a limit. If not want to remain in your house to get more than a few years, this may save towards the interest repayments.

4. Focus Merely Financial

In some instances, a lender can present you with a destination just home loan in which you have to pay on attention with the earliest 5 otherwise ten years. Up coming months, it reverts so you can a conventional home loan with repaired prices. This may take longer to settle but may come in handy if you’re having difficulty with the monthly installments.

5. Merchant Carryback Money

For the a consumer’s sector, providers could draw in people with unique concessions to find a good price over. Certainly one of that is provider carryback investment. In cases like this, the vendor will act as the bank or financial and you can get a great next mortgage with the assets along with the buyer’s first home loan. Each month, the customer takes care of one another mortgage loans. This may also feel referred to as holder financial support or seller funding instant same day payday loans online Mississippi.

6. Owner-Occupied Loan

Should your assets concerned are a duplex or multifamily household, the customer can buy an owner-filled mortgage. In this case, people may use the latest leasing earnings on possessions to help you underwrite the mortgage having high loan limits. The home should have finalized leasing rent preparations in order that repayments is verified. These are thought resource services very private loan providers might require higher off costs, generally between twenty-five-30 % off. The latest Virtual assistant and you may FHA may also work at people with the holder-filled finance.

7. Agricultural Loans

Ag loans are for sale to attributes with 10 or higher acres and have now no limitations having proprietor versus. non-manager filled. They are services which have orchards, farms, vineyards and. Red Hawk Realty circumstances farming financing to possess eligible properties that have flexible money choices. Contact all of us for more information.

Deciding on an excellent fixer-top to own a fix and you may flip? Listed here are worthwhile suggestions for augment and you can flips out of a specialist in your neighborhood Brock VandenBerg and determine just how a challenging loan provider instance TaliMar Financial makes it possible to!