rates the borrowed funds repayments for the a house bought at the true Property Institute out of NZ’s national all the way down quartile cost will have declined from the as much as $81 per week anywhere between February and August this present year, whether your home was actually ordered having good 20% deposit.

That is because this new national straight down quartile speed declined away from $600,000 when you look at the February in order to $577,500 in the August, while the mediocre two year repaired financial price e period.

One to fortuitous combination not merely less the amount who would you prefer is purchased property within lower quartile rates, additionally faster the quantity you’ll need for a deposit, how big is the loan necessary to make buy and you may the amount of the loan repayments.

including measures up the loan costs outlined significantly more than, resistant to the median earnings from people old 25-31, locate a standard measure of value.

The brand new declines in cost and you may home loan rates means most of the countries of the nation are in reality considered sensible getting regular basic house buyers, considering they could abrasion to one another a 20% put.

That’s also genuine to your Auckland region, and therefore tucked according to the forty% cost endurance the very first time inside the nearly three years in the August.

The final date Auckland homes met the fresh affordability standards are , if the mediocre two year repaired mortgage price was only step 3.02%.

In fact the fresh new down moves within the cost and you will rates suggest really the only districts today sensed expensive to own regular first domestic people try Queenstown, and Rodney plus the North Shore inside the Auckland.

Some one to shop for a house at federal straight down quartile cost of $577,five-hundred would need $115,five-hundred having an effective 20% put, if you’re within the places a 20% put carry out vary from $71,000 for the Southland to $154,000 inside Auckland.

Getting in initial deposit together can be the biggest difficulty against prospective basic homebuyers normally income, especially in part of the centres.

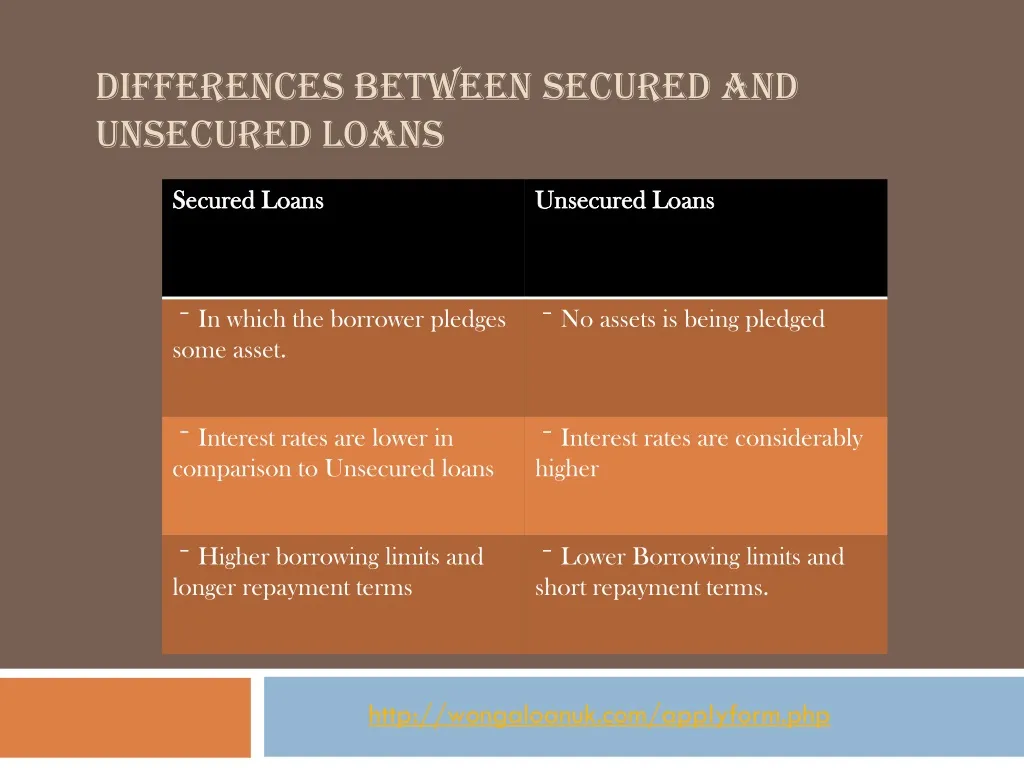

Men and women desperate for a good 20% deposit you will thought a reduced equity mortgage having an inferior put, however financial institutions charge substantially more having lowest equity mortgage loans on account of the greater threats in it, hence gets the effect of significantly increasing the mortgage repayments, which decrease their affordability level.

However, there is not any simple path to home ownership, the latest styles during the last half a year would has provided a slightly easier highway for almost all earliest home buyers.

The brand new tables less than supply the chief affordability strategies getting typical earliest homebuyers in most of your own country’s countries and fundamental metropolitan districts.

Very first homebuyers try viewing the great benefits of decreasing home pricing and the present falls during the financial rates, which have a hefty change in mortgage affordability over the last half a year

- The latest opinion weight on this blog post is now finalized.

*This post was authored in our email to own paying readers in the beginning Monday day. Look for here for more facts and the ways to sign up.

Your access to the novel and unique blogs is free of charge, and constantly might have been.But ad revenue is actually under pressure therefore we https://paydayloancolorado.net/rifle/ you desire your support.

Followers can pick any count, and can get a premium advertisement-totally free experience when the providing a minimum of $10/month otherwise $100/seasons. Discover more right here.

Remember we allowed powerful, polite and you can insightful debate. Do not anticipate abusive otherwise defamatory comments and will de-sign in those individuals several times and then make instance statements. Our very own most recent remark policy is here.

55 Statements

Future, better, value is originating, wait till 2027 to help you 2028 locate a good bargain off a highly Ponzi inebriated and you will liquidating Landlord.

Just promote cost throughout the dated 2015 to 2018 valuation price variety, since this is how costs are oriented (otherwise down??) since the the individuals thousands which can be regarding horrors regarding Negative Guarantee. usually do not strongly recommend it, as the almost all their deposit money (+some) possess evaporated, such a fart from the wind!