For those who have a lot of high-interest debts, thought combining all of them. This will make clear the debt elimination means by creating cost much simpler to monitor.

Debt consolidation lowers your DTI ratio instantaneously since you build just you to definitely fee. From the uniting the money you owe not as much as more substantial one, it can save you cash on focus money. New savings are specially visible for people who combine all of them with the a beneficial reduced speed. And since you’re merely making that percentage, you have freed up even more bucks. Thanks to extra repayments, you can even pay them regarding faster and you will save well on interest.

It will keeps a primary disadvantage. Consolidation features a bad effect on your credit rating. People just consolidate the costs whenever they believe having several simultaneously is actually difficult. Hence, many lenders including perceive them once the large-exposure. If you want to keep your credit score, is paying down the money you owe one by one alternatively.

Pigly’s Alerting!

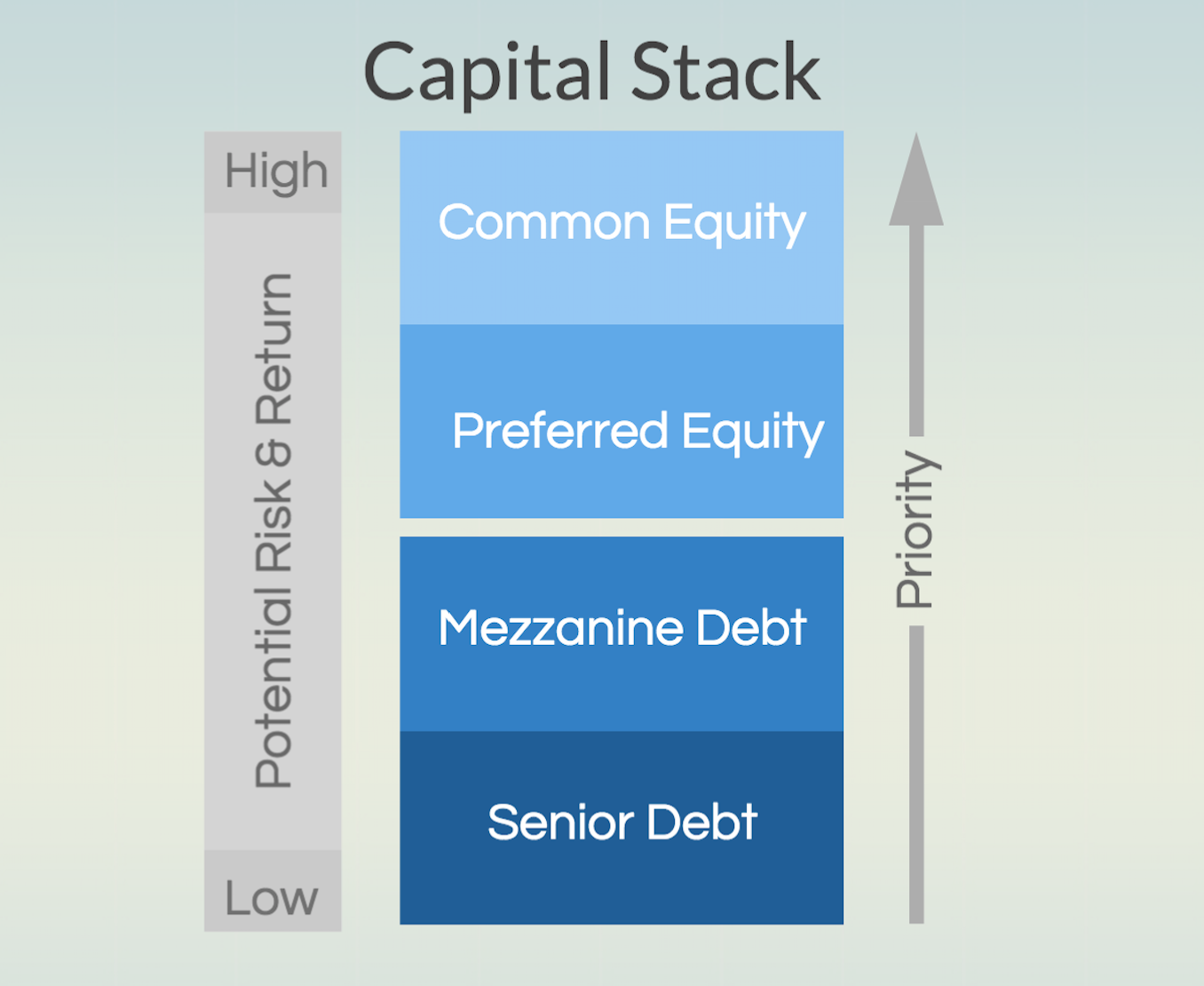

For individuals who currently bought a property, you happen to be tempted to obvious their most other expenses courtesy https://elitecashadvance.com/installment-loans-ar/el-paso/ cash-away refinancing. This involves replacing your mortgage having more substantial mortgage along with what you already are obligated to pay on domestic and adequate to safety your other expenses. The difference is provided to you personally because dollars, used to pay off expenses. Although you can easily clean out the other obligations costs, in addition, you increase your month-to-month mortgage payments and place your home at stake.

Cosigners

Even although you can pay of your individual debts prompt, its consequences on your DTI proportion is almost certainly not adequate. You happen to be trapped with other expenses one grab ages to help you clear, or reside in a top-book city. Such intervening items could make it difficult to take off your own DTI proportion. In other minutes, you won’t manage to straight down it punctual adequate to just take advantageous asset of all the way down cost or all the way down costs. It is short for your past challenge into affording a home.

Whenever options rates is found on the range, you ought to think all the possibilities for your use. In these instances, you can get a cosigner to suit your financial. Brand new cosigner agrees to blow your home loan if you can’t. From the revealing the burden of your financial with anybody else, you are seen as much safer by your financial.

Getting a great cosigner might be the finest price if you don’t some meet the requirements on paper but could pay for a monthly financial. Whatsoever, you will find just plenty can help you to switch debt metrics on the quick see. The extra money might alternatively serve you finest heading to the an excellent huge advance payment.

The selection of cosigner things. Besides that have a stable income, the cosigner should also have an effective credit score. The better their cosigner looks into the lenders, more your chances of getting acknowledged. The fresh cosigner you decide on should feel dependable. Anyway, they’ll certainly be having your back when you somehow are unable to pay the mortgage.

The conclusion

The DTI ratio is the linchpin for some of one’s major financial behavior. Thus, minimizing it must be important. It has got a multitude of experts along with boosting your odds of loan recognition. Having a lot fewer expenses translate to help you deeper cash flow. This can help you strengthen your own deals to possess down repayments, problems, and you may later years. Simultaneously, lowering your expenses plus advances your credit score.

As important as its, your DTI ratio isn’t the simply grounds when considering good home loan. You will need to reduce your expense in order to winnings their lender’s believe. Examine your finances with care and make sure you know where your finances is certainly going. You might find that your budget is a lot lower than their latest DTI proportion create cause you to think.