The borrowed funds so you’re able to an exclusive household members buyer goes into the the purchase greater than 5,500 called and you can partially setup tons during the San Joaquin State, CA-city Mountain Family, a great storied structured people if at all possible appropriate a hybrid functions day from the better San francisco.

Financing

The borrowed funds in order to a private relatives buyer will go on the purchase of greater than 5,500 named and you will partially setup tons within San Joaquin County, CA-city Mountain House, a good storied organized neighborhood essentially suited to a hybrid really works month about better San francisco bay area.

In one of the more difficult, not sure, and you may volatile economic backdrops when you look at the present memories, an affiliate of Builder Advisor Classification finalized now into the a beneficial $362 mil basic-lien loan just like the head bank towards acquisition of a crown jewel North California grasp arranged community’s left property.

In spite of the scale and you will difficulty of your own endeavor, our very own member demonstrated being able to disperse easily, and you can intimate ab muscles highest mortgage inside a couple months,” claims Tony Avila, President from Creator Advisor Category, a recruit partner of your Builder’s Everyday.

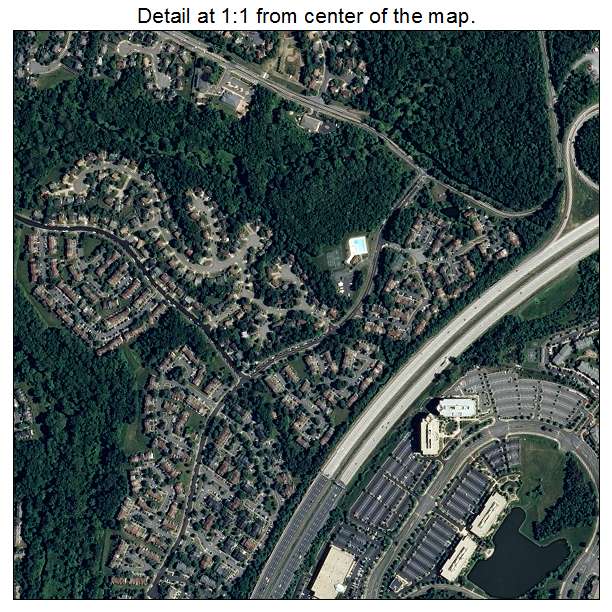

The loan so you’re able to a private family customer is certainly going toward the acquisition greater than 5,five hundred called and you can partially install plenty during the San Joaquin County, CA-urban area Hill Family, good storied prepared neighborhood, ideally ideal for a crossbreed performs few days regarding better San Francisco San francisco.

It picturesque society now offers want the newest homes, impressive amenities, in addition to whole San francisco bay area try really within reach through Roads 205 and 580. From the complete build aside Mountain House might possibly be home to far more than 49,000 residents and have a great Safeway secured https://paydayloanalabama.com/lynn/ mall (already inside the lease upwards, Safeway unsealed inside the ), a position hubs and you can numerous homes potential.

Hill Home is an investment chance comprising the income from the brand new entity one to owns the remainder step three,646 unmarried-family plenty, 120 miles from typical-highest and high-density residential, 52 miles out of blended fool around with property, and you will 91 miles out of commercial, commercial and you can farming land.”

The vendor about bargain was CalPERS – the new Ca Public Employees’ Retirement System which invested in obtaining dos,eight hundred acres of your own community, initially while the somebody of Shea Land, inside the 2005 regarding the MPC’s new developer Trimark Teams.

In 2008, from the point where the subprime mortgage crisis had morphed with the a foreclosures flooding, The latest York Minutes labeled the masterplanned community as the utmost under water community in the usa. Correct, thinking had gone from the cliff smaller than just some body would have questioned. And you will sure, there had been quite a few foreclosed properties to have anyone’s liking freckling the fresh after-thriving streetscapes of one’s community’s nascent communities, which in fact had only received their start in 2003.” Large Creator

Because of the , the newest $step one.12 billion financing because of the CalPERS got shorter in order to 18% of these shape: $two hundred million. Even if home prices had dropped significantly, CalPERS determined that they will retain the newest resource, relying on a recovery of your housing marketplace.”

Exactly what it setting

In a great Q2 2023 money phone call the other day that have financing analysts, Five Affairs Holdings president Dan Hedigan generally telegraphed an outlook having finished-parcel consult, especially in really-depending masterplan communities:

We come across the house catalog stays very low, increasing demand for and you may demand for the newest property,” states Hedigan. „When you are cost has been problems, houses has been in short supply inside our Ca segments and there’s still demand for well-discovered house and you may grasp package organizations. Home development was a lengthy game, so we are just early in the game within several of our very own teams, but they are perhaps not and work out any longer house and there tend to never be many titled end up in California.”

Finished-parcel demand among designers might have been cresting just like the we listed in stories here that’s where for the past day on account of exactly what seems are a still-hardening lift during the this new-house request because of about three items:

- (1) developers was basically ready 'pricing-in’ way more speed-sensitive and painful homebuyer candidates having home loan software and you may incentives, and you may operating pace which have circulate-up and way more discretionary buyers having improvements and selection.

- (2) existing domestic listings can be found in limbo because of latest people resistance to allow go out of significantly less than cuatro% 30-seasons financial cost, and you may

- (3) plateauing „higher-for-longer” rates of interest was gaining greater tolerance as a special-norm peak; one which of many customers fret from the reduced today while they faith they will more than likely refinance at the top words contained in this a year or several.

Profile on you to sustained elevator provides triggered a general increase in builders’ appetite getting homesites, as their latest offers are becoming absorbed sometimes reduced now than just requested. Many builders enjoys established stores of money willing to set up place for homes purchase, not just to continue the machines given during the current height, however, so you’re able to ignite gains and you can earnings.

The financing origination in the Creator Coach Group is just one of greater than $600 mil within the land financing the group have completed in brand new earlier 7 months.