Getting a dad is an emotional, daunting and you may pleasing amount of time in your life. There was really to prepare to own and you’ll be balancing many different positions, together with caregiver and you can merchant. Whether you decide to getting a stay-at-house moms and dad, or it will become your best option individually throughout certain seasons of life, you happen to be curious how you can still take care of and you will help make your borrowing from the bank.

If you find yourself working area-time for you to make money is a choice-eg flexible remote work-it is far from fundamentally possible for all, particularly having a child. On this page, you will see about certain ways you can always create borrowing from the bank since the a-stay-at-home mother or father.

An easy way to create credit in place of an income

Because the yet another father or mother, there are lots of things would have to lose, as well as, plenty which you yourself can gain-although not, your own borrowing need not be one of several items that endures. Below are a few methods always build borrowing while the a stay-at-house mother in place of a living.

Be a third party representative

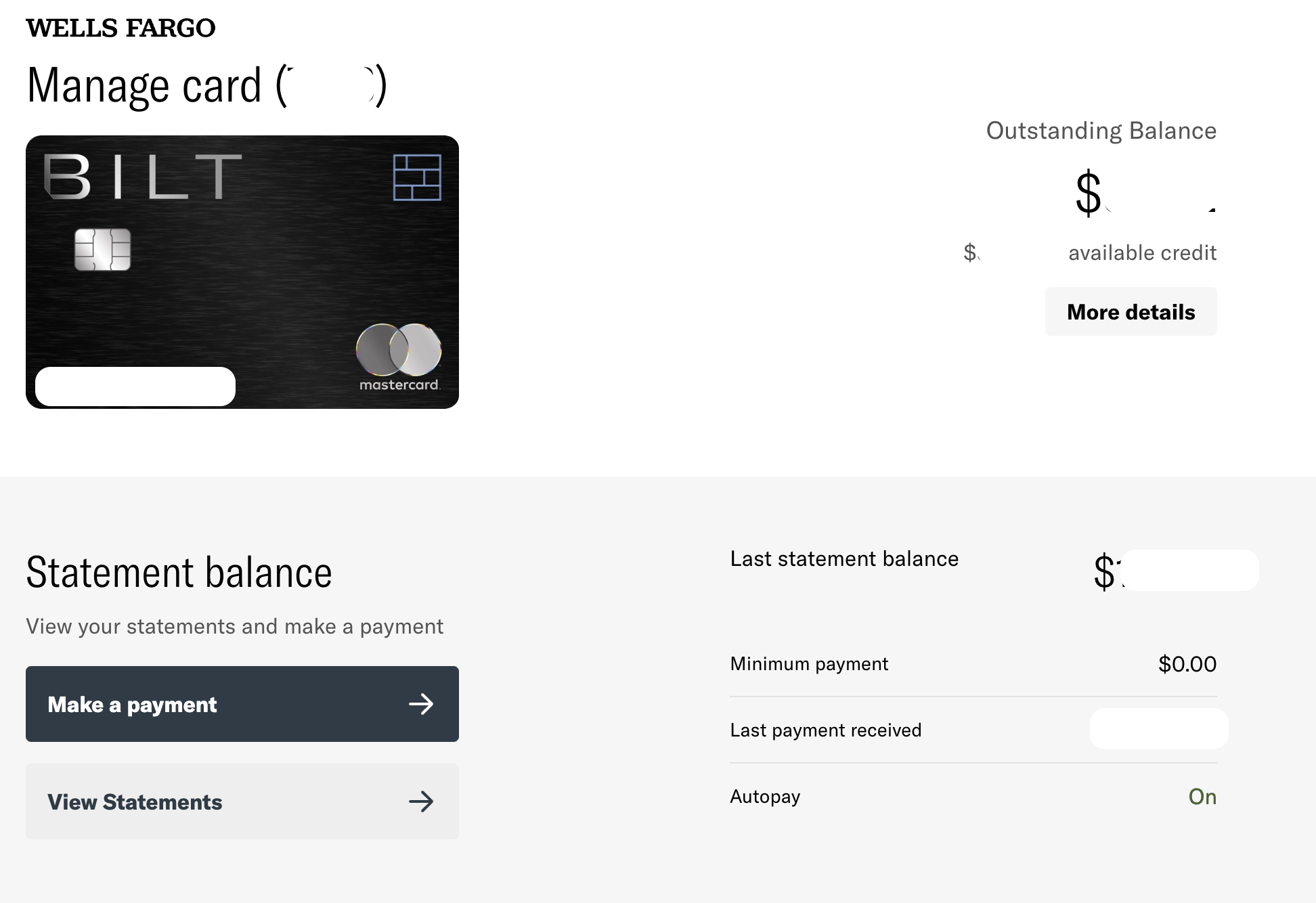

A proven way you can consistently generate borrowing just like the a stay-at-home moms and dad in the place of a full time income should be to become a 3rd party member. Such as for instance, should your lover is actually doing work, they could put you while the an authorized associate on the credit card. This will will let you utilize the credit because if they had been your own. The primary membership holder (in cases like this, your ex) carry out nevertheless be responsible for deciding to make the repayments, however your identity will in addition be for the membership and supply your with the opportunity to online payday loans Wisconsin build credit. Exactly how this work is the fact that credit history of the credit may be the credit score on your own credit file provided that as you will always be a 3rd party affiliate.

Bear in mind if you’re weighing your options one, because the a 3rd party affiliate, their credit may go 1 of 2 ways. It might alter your borrowing (if the no. 1 cards owner is actually responsible having to make the month-to-month payments) otherwise harm your borrowing from the bank (in the event your first credit owner is reckless and defaults). Given that an authorized associate, the borrowing from the bank are influenced by the main credit holder’s conclusion once the they relates to their credit, costs and you may monetary government.

Consider utilizing appropriate credit cards

Even though you do not have a reliable income, you might continue using their credit cards in many ways that benefit you. This may involve playing with credit cards offering rewards to have issues eg goods, gasoline and you can eating. Which have elevating youngsters, possible certainly become and then make reoccurring requests that will possibly sound right to earn your advantages, savings and other professionals.

Such cards may include store handmade cards (certain to help you a specific shop otherwise chain regarding places contained in this a beneficial network) or playing cards that will include certain perks otherwise lower annual fee pricing (APRs).

Fool around with free systems such as for instance Pursue Credit Trip that will help you

Expecting means loads of added costs-you are probably aspiring to conserve costs whenever possible otherwise are wanting to know how to keep credit history amidst every the latest expenditures. Consider using free online products such as for instance Borrowing Excursion so you’re able to display screen and you can possibly replace your credit history. You can aquire a customized package available with Experian so you can do so adjust the rating to ensure that it’s within the good reputation just before and you can during the parenthood.

- Discover a no cost, upgraded credit history as often as the all of the 1 week

- Screen and you can tune your credit rating over time

- Enroll in borrowing from the bank overseeing and you may title monitoring notice to help keep your details secure

- Power 100 % free instructional resources to aid better know your credit rating

- Use the credit believed ability to help you map their coming credit rating

Set tools and other qualities on your own identity and outlay cash per month

Regardless if you are promoting earnings of another resource or discussing your partner’s income to pay for expense, lay electric bills and you can recurring expenses under your label to build enhance payment history and employ credit cards to expend them of. However, guarantee so you can finances carefully of these form of repeating costs.

Payment record is actually a major component that becomes thought when calculating your credit rating. Gathering a very good, uniform percentage record can help you to build borrowing from the bank because the an excellent stay-at-domestic parent. While you’re and then make your payments timely, that is an excellent way to help alter your credit get throughout the years.

Open a shared account with your partner/lover

Should your mate is offering a source of income and you can takes aside that loan, consider having your identity detailed near to theirs. Opening a mutual account along with your companion (eg a car loan) may help diversify your own accounts, that may replace your borrowing combine. This will help you obtain credibility on the sight out of loan providers which help build a more powerful credit history through the years.

Building borrowing since one mother or father in the home

If you find yourself an individual, stay-at-home-parent, it might not become feasible to complete all of the above. It’s also possible to believe looking at one kind of bodies benefits which will affect your.

If you find yourself effect overloaded or confused, always get in touch with individuals which value your getting service. Explore certain choices which have family unit members before the child happens thus you will get an agenda positioned, including who will help see your son or daughter even though you work.

To conclude

Are a pops was an exciting go out, in addition to very last thing we wish to worry about as you get ready for parenthood is the state of one’s credit score. You could prevent worrying precisely how your credit score is doing of the existence hands-on and you will patient, causing you to be more hours to focus on your youngster.