Regardless if you are a highly-mainly based medical practitioner or just entering your work, selecting the ideal lender are a daunting task. Fifth 3rd Financial even offers a doctor home loan program designed to meet up with the specific financial need of physicians. Of several medical college students graduate having significant financial obligation, nevertheless 5th 3rd Financial doctor mortgage was designed to serve their economic activities in a way that a traditional home loan might not.

What exactly is Fifth 3rd Financial?

Created from inside the 1858 in Cincinnati, Ohio, 5th Third Bank operates inside 11 states and contains more than step one,100 part towns and you can 2,3 hundred ATMs. That have assets totaling $554 mil, its among the many biggest currency managers regarding the Midwest. The bank also provides a variety of attributes including checking and you will savings, home business banking, domestic and you can automotive loans, money places, Dvds, and you can pupil banking. Having small businesses, 5th 3rd Financial provides playing cards, money, checking and you will coupons levels, and cash administration solutions also provider attributes and ACH collections. This enables businesses to accept each other debit and you can mastercard repayments.

The name Fifth 3rd originates from the mixture of one’s labels of your bank’s prior one or two carrying organizations, New 5th Federal Bank as well as the Third Federal Bank.

When you look at the 1908, the brand new Fifth-Third Federal Bank from Cincinnati was formed if several finance companies matched. The brand new bank’s advertising undergone numerous changes up until it absolutely was fundamentally known since the 5th 3rd Bank within the 1969. Usually, 5th Third Bank provides received numerous people, leading to the newest status among the biggest banks in the usa. They currently retains the latest 308th review to your Fortune five hundred listing of your own prominent businesses in the nation.

Fifth Third Doctor Mortgage Features

5th Third Financial provides a health care provider loan you to suits the a mortgage criteria regarding dieticians. Whether or not they was this new otherwise educated, physicians can also enjoy this package to obtain fixed otherwise adjustable-price mortgage loans for choosing otherwise refinancing a home. Concurrently, personal home loan insurance policy is perhaps not required. Those people who are permitted sign up for this loan try:

- Physicians (MDs)

- Doctors away from Osteopathy (DOs)

- Physicians off Dental care Medicine (DMDs)

- Physicians from Dental Operations (DDSs)

- Ds)

5th Third have one or two loan options available for people based on the work position. These types of selection are the Created Physicians and Dentists program, together with People, Fellows, and you may The new Physicians system.

Practicing Physician and you can Dental practitioners

This program try accessible to people who contain the specified designations and also a minimum of one seasons of experience within their particular industries.

- Attending 1+ years

Owners and you will Fellows In Degree

This choice is available to the people who hold the designations stated a lot more than and are usually already undergoing studies otherwise had been likely to getting below annually.

The borrowed funds exists for both buy and you can re-finance from unmarried loved ones land or condominiums less than both program. There’s absolutely no clear reference to Fifth Third’s certain loans-to-income requisite, however, college loans may not be experienced. Training physicians need to have the absolute minimum credit rating out of 720, if you find yourself physicians nonetheless in degree you desire a rating of 700. It needs to be noted one 5th Third Bank isnt available all over the country, and simply citizens or those people browsing go on to specific claims are eligible. The new claims out-of Ohio, Fl, Georgia, Illinois, Indiana, Kentucky, Michigan, North carolina, Sc, Tennessee, and West Virginia compensate it list.

Fifth 3rd Bank Physician Financing Choices

Securing home financing is a big choice and is also crucial becoming really-told about all the options available also to inquire commonly before selecting a loan provider. Evaluate these alternative alternatives as well as 5th 3rd Financial.

UMB Lender

Getting medical professionals, UMB Lender provides a monetary alternative enabling having 100% investment up to $1MM. not, a family doctor need to be currently browsing in the place of nevertheless at school so you can be eligible for full resource. On top of that, it is essential to note that the bank’s exposure is bound, so it’s needed to verify the visibility in your state just before continuing.

Truist

Truist was shaped through the mixture of BB&T and you can SunTrust. The application brings complete capital around $1MM for the next designations: MD, Carry out, DPM, DDS, DMD.

You.S. Bank

U.S. Bank was a national bank in all fifty claims, but their d is only designed for MDs and you will Dos. When you have one of those values, you might rating 90% financing up to $step 1.25MM.

Try Fifth 3rd Financial Best for you?

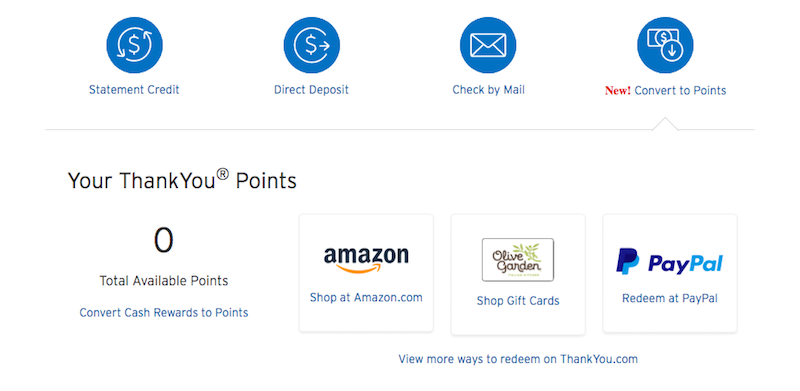

Fifth Third Bank provides finance in order to scientific faculty that happen to be the newest or established in their field, giving much more positive terminology to enable them to just create their work, and in addition get her house. not, is this types of lender the best option choice for your position? As they do promote done capital, it is simply available up to $1MM. He’s a complete-provider lender, and therefore you’ll be able to manage your home loan repayments online and even-set upwards automated payments because of the customers program. While doing so, if you are considering doing your scientific practice , 5th Third provides smaller businesses, it is therefore a great options. It should be listed, not, this particular bank enjoys a limited exposure in just eleven claims. Also, for individuals who require a jumbo financing, such as for instance $2 billion, attempt to set-out no less than ten%.

Fifth 3rd Bank FAQ

It is usually best that you see doing you might on the the financial institution you’ll enter into a possibly 31-12 months connection with.

Is actually 5th 3rd Bank a great place to score home financing?

Along with providing private financial, Fifth Third Financial offers advantageous assets to doctors who happen to be only getting started within jobs. Aside from your debts, 5th Third Lender makes it simple getting physicians so you’re able to plant the roots loan places Longmont in which its job starts and ends.

Does 5th 3rd Bank give habit financing?

Zero, even so they would bring home business financing that are backed by the tiny Organization Administration (SBA). SBA finance and you can credit lines offer a lot more flexible borrowing quantity and cost options, for example all the way down monthly obligations to you and provides a limit to $5 billion. Loans can be used getting commercial a house expansion/the new construction, working-capital, gadgets funds, and refinancing established obligations. And also as claimed prior to, 5th Third Financial has home business financial, along with deposit levels, credit cards, and debit and you will mastercard handling choices.

Do you require a health care provider home loan over and over again?

It depends into bank you may be handling. Very will allow subsequent finance if you meet up with the criteria. But remember that physician mortgages are formulated mostly for those who happen to be no more than a decade away from residency. For people who exceed that point body type you will possibly not have the ability to locate these loan even although you apply that have an alternative financial.