During the GRB, i improve procedure for obtaining a home mortgage mortgage or refinance as simple as possible. All of us off knowledgeable real estate loan loan providers when you look at the Western and you may Central New york will meet along with you to discuss their resource choice. There are many different lending options therefore we aid you to dictate the borrowed funds mortgage that is right to suit your state. Assuming you may be willing to pick, you should have the newest pre-certification you’ll need to set up a robust offer. You get timely approvals, too, since the credit decisions manufactured in your area.

Read more on the all of our loan things, mortgage associates and employ the on the web calculators to start the fresh new technique to owning a home!

- All of us

- Funds

- Real estate loan Calculator

- Refinance mortgage Calculator

- Contact us to get started

On the web Software and you will Home mortgage Finance calculator

You can expect fulfilling phone calls otherwise video chats with your GRB home loan class, in addition to an easy online home loan software.

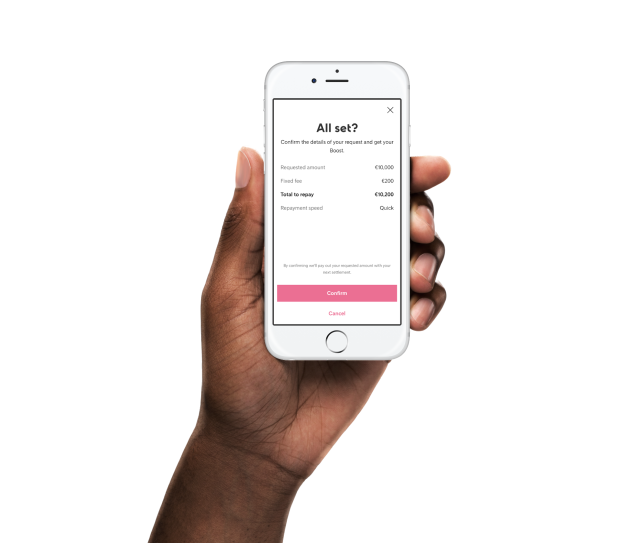

New GRB Home loan Express mobile software makes it easy and convenient to utilize and you will take control of your mortgage. You can utilize the mortgage calculator to test payment pointers inside live. Use the software to publish data files making use of your cellular device’s digital camera, and you will sign-off into paperwork playing with age-signature.

GRB is actually a nationwide registered home loan bank, so you’re able to keep it regional and employ the on the internet app and you will mobile software even when buying an extra domestic out-of condition.

Prequalification or Preapproval?

You have read the news, the genuine home field for the New york county is scorching. Possible consumers usually see on their own while making numerous also provides until one online installment loans Oakland is actually acknowledged. To increase your chances of bringing a recommended bring, believe securing a mortgage preapproval instead of a beneficial prequalification.

Prequalification An excellent prequalification is a first step-in the loan procedure where a loan provider estimates how much you might be in a position to acquire predicated on recommendations your offer regarding the money, property, expense, and you will credit score. Typically, prequalification pertains to a standard comparison of your financial predicament, usually complete informally and you may versus an intensive overview of your borrowing from the bank report. Prequalification provides you with a rough concept of just how much you could potentially be able to use, but it’s maybe not a promise. The true amount borrowed and conditions can differ shortly after a more thorough overview of your money and you can credit history.

Preapproval Good preapproval was a official techniques in which a loan provider very carefully evaluates debt history, plus money, property, expenses, and you may credit score, to choose how much these are generally willing to give you. Providing good preapproval comes to submission documents instance pay stubs, W-dos versions, financial statements, and you may agree into lender to get your credit report. The lending company upcoming verifies everything offered and you can analyzes their creditworthiness. An excellent preapproval try a stronger manifestation of your own credit power opposed so you’re able to prequalification. While it’s perhaps not a vow off that loan, it carries more excess weight that have manufacturers whilst pertains to a more thorough report on your bank account from the financial.

In summary, prequalification is actually a primary evaluation considering information you bring, if you are preapproval comes to a rigid analysis of profit, in addition to documentation and you can credit score. Preapproval can be believed even more reliable and assists create a stronger provide when you look at the a home purchases.

Strengthening More powerful Areas Offering Western and you may Central Ny

GRB has some mortgage loan financial loans as well as: first-date homebuyers; down-payment advice; grants; conventional finance; FHA, Virtual assistant and you may USDA bodies fund; and you can many special software made to change your residence having dreams to your a real possibility.

Below are a few The Most other Attributes

GRB also provides a portfolio monetary functions to aid your organization build, service your everyday banking demands, which help you order or refinance your property.

Private Financial

During the GRB, personal banking is actually private. We offer a variety of financial activities to support each of the financial need, following meets them up with an individual services experience tailored to help make your economic coming.

Commercial Banking

At the GRB, we realize one taking your company to a higher level need an incredible period of time, believe, and also the proper partnerships. Our very own industrial banking cluster has the benefit of all that and so far far more. Having small, locally generated approvals, we’ll put you to your timely tune to meet up your business needs.