FHA Loan

FHA fund bring a bonus over traditional fund since they’re supported by the brand new FHA or even the Federal Casing Government, the planet’s prominent mortgage insurer. New FHA cannot lend currency, instead it straight back the lenders should the borrower’s default to your financial.

- Is actually first time home buyers

- Has mediocre, worst otherwise minimal borrowing from the bank

- You prefer a smaller deposit alternative

- Need think stretched co-debtor choice

Bridge Mortgage

Such funds are usually for many who was moving from just one where you can find others and wish to use the collateral towards its existing domestic, to get a downpayment to their brand new home. This type of loan will act as a changeover automobile ranging from several services and you can lets consumers to get into collateral within their newest home to utilize since down payment because of their next buy. We enable it to be individuals to financing doing 80% of the appraised value of its established domestic.

- Offer your current domestic and purchasing a unique domestic or are preparing to have your home built

- Focus the convenience of a smooth financing into the offering procedure of your latest home

USDA Financing

A good USDA financing or even called the newest Rural Housing Loan keeps a 30-12 months label with an intention speed set by lender. There is no lowest down payment and you can allows 100% capital. It will features income and you will borrowing requirements so you can qualify and certainly will Only be employed for number one house.

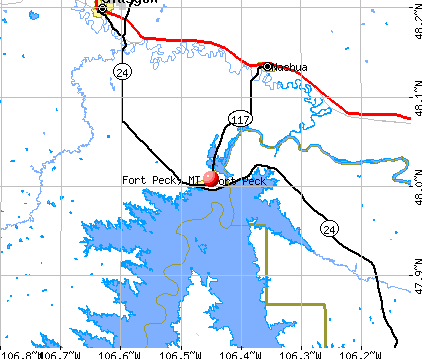

- Reside in an outlying town

- Have good credit and proven money

- Plan on remaining in the house 5+ years

Lot & Residential property Loans

These style of money are having either short- or much time-name financial support. A great deal financing try brief-term financing always pick a better lot who has got interfering with and/otherwise utilities positioned, towards the intent to create another family or cabin into the it within this West Mountain CT cash advance annually. A secure Mortgage try long term, typically familiar with purchase brutal property and will not need be improved homes that have tools in position. A secure financing is typically employed for somebody seeking homes in order to play with having sport otherwise coming generate. Such money will get match your economic means smart to:

Lake Area Home loan also provides a wide range of mortgage loans, to fit any house buyer. Remember, the down-payment direction preparations arrive to the some of our mortgages; be sure to enquire about your options

Call us toll-free from the step one-866-321-1566 to talk to a lake City Mortgage lender otherwise go to our site at the River Town Financial now! All of us work along with you to assist determine which financial types of is perfect for you!

***Mortgage loans is actually originated of the River Area Home loan, and are at the mercy of borrowing acceptance, confirmation, and you will guarantee review. Software, also offers, prices, terms, and criteria are at the mercy of alter otherwise cancellation without notice. Specific requirements pertain. ***

So it report contact affordable houses when you look at the outlying components on the Joined States together with upper Midwest, that have a particular focus on criteria in the Minnesota. Inside framework, we offer detailed information regarding the new stock regarding multifamily houses that falls under the usa Company away from Agriculture (USDA) Area 515 casing system and you can assess the scale and scope of lingering concerns associated with the future of this choice. Since qualities from the Area 515 system mature outside of the system next ten to help you 3 decades, Minnesota really stands to get rid of a substantial proportion out of rental property already employed by lowest-income house into the nonmetropolitan aspects of the state. With no obvious backup plan for maintaining value during these features, some of the attributes as terms of the cost limits end. This might imply new displacement of several renters surviving in 515 qualities that believe in the new construction subsidies that accompanies these units.