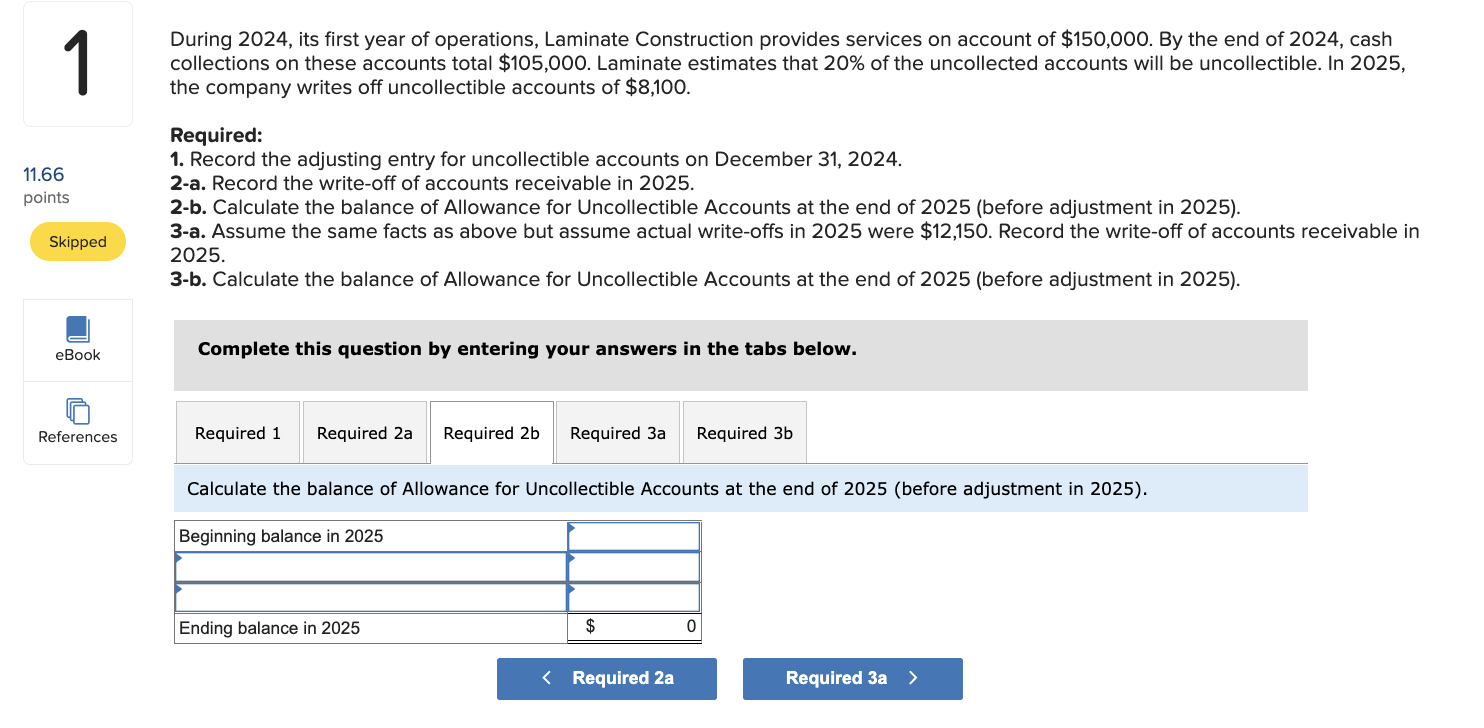

Tax of great interest Paid off into House Guarantee Funds

- New debtor should very own at the least fifteen% to help you 20% of the property become sensed an appropriate applicant for a home equity loan.

- The new shared loan-to-really worth proportion of the home cannot surpass 80%.

- The new borrower’s personal debt-to-income proportion should be lower than 43%.

- The absolute minimum credit rating out-of 620 is sometimes expected.

- The home and that is put since guarantee should be appraised of the a third party which is approved otherwise appointed by the bank.

Repayment off Home Security Fund

Household guarantee finance are given due to the fact a lump sum, and so they can be used for various intentions. These types of fund was paid down owing to a set of installment payments that always increase out-of 10 so you can twenty five years.

For every single payment includes area of the loan’s outstanding harmony and you will an attraction fees reduced into the financial while the payment to own assisting the amount of money. While the for each and every fees was paid down, this new resident more and more recoups the main residence’s security.

Just before 2017, the eye costs paid back with the home equity finance was completely deductible of another person’s taxation. So it increased the latest popularity of these money simply because they was indeed a great cheaper replacement other kinds of individual funds.

Nonetheless, the new Income tax Slices and you can Occupations Serves of 2017 eliminated the choice from subtracting the eye paid within these loans apart from circumstances where in actuality the loans are accustomed to buy, generate, otherwise boost the taxpayer’s family. (więcej…)