Are you gonna be to buy a property soon? In this case, it is critical to understand the character your credit score could play in the act.

Among the first questions one real estate agents usually query an excellent homebuyer when they start working together are, Do you have a home loan preapproval but really?

Most people are hesitant to get preapproved having a home loan once the he or she is afraid of the way it you are going to apply at the credit rating. That is readable, since your credit rating is an essential part of going acknowledged for a financial loan. Fortunately one to providing preapproved to own a home loan otherwise mortgage doesn’t have in order to harm your credit score-actually, it will actually save a little money eventually. Let us evaluate as to the reasons this is and how you can get pre-accepted rather than affecting your credit rating.

Mortgage Pre-Approval: What you need to Learn

A home loan preapproval 's the first faltering step at your home funding & home buying techniques. It is a great stamp out of acceptance off that loan officer or financial. A home loan preapproval page will provide you with the following pointers, in fact it is distributed to your own real estate professional additionally the sellers of one’s land we wish to pick:

- Exactly how much you can acquire

- An estimate of one’s interest rate might purchase

- The borrowed funds term

direct lenders for bad credit installment loans WV

It’s quite common to possess homeowners so you’re able to confuse a mortgage pre-recognition having a great pre-qualification. Good pre-degree 's the basic stage of one’s lookup techniques when someone is merely looking standard recommendations on what mortgage choices and you will money are available to all of them centered on let’s say situations and you can guidance.

When a buyer have determined they are doing want to look, examine, and place an offer in the for the property, occurs when a beneficial pre-acceptance is required. A good pre-acceptance always concerns a credit check and you may opinion, and providing additional information on mortgage manager, that may help you all of them leave you information and you will options for whenever you do find best house. However the financing officials often collect documents for the preapproval process, we recommend you submit your papers at this stage to guarantee the the very least amount of shocks and you can mistakes on the roadway.

The method: What are the results When you get Preapproved?

If you get pre-approved to own an interest rate that have a lending company or mortgage agent, they often carry out a great smooth eliminate of your credit file that does not apply to your current get. A soft pull and does not show up on various other lenders’ records as soon as you go trying to find rates after down-the-line it’s not going to harm your. The goal of it inquiry is basically to verify earliest information instance simply how much loans you really have, the new monthly installments, additionally the complete monetary health of your own borrowing from the bank therefore the lender can be dictate a suitable amount borrowed with the borrower. As long as individuals remain its personal debt-to-earnings ratio less than 45%, they should haven’t any state qualifying for some money.

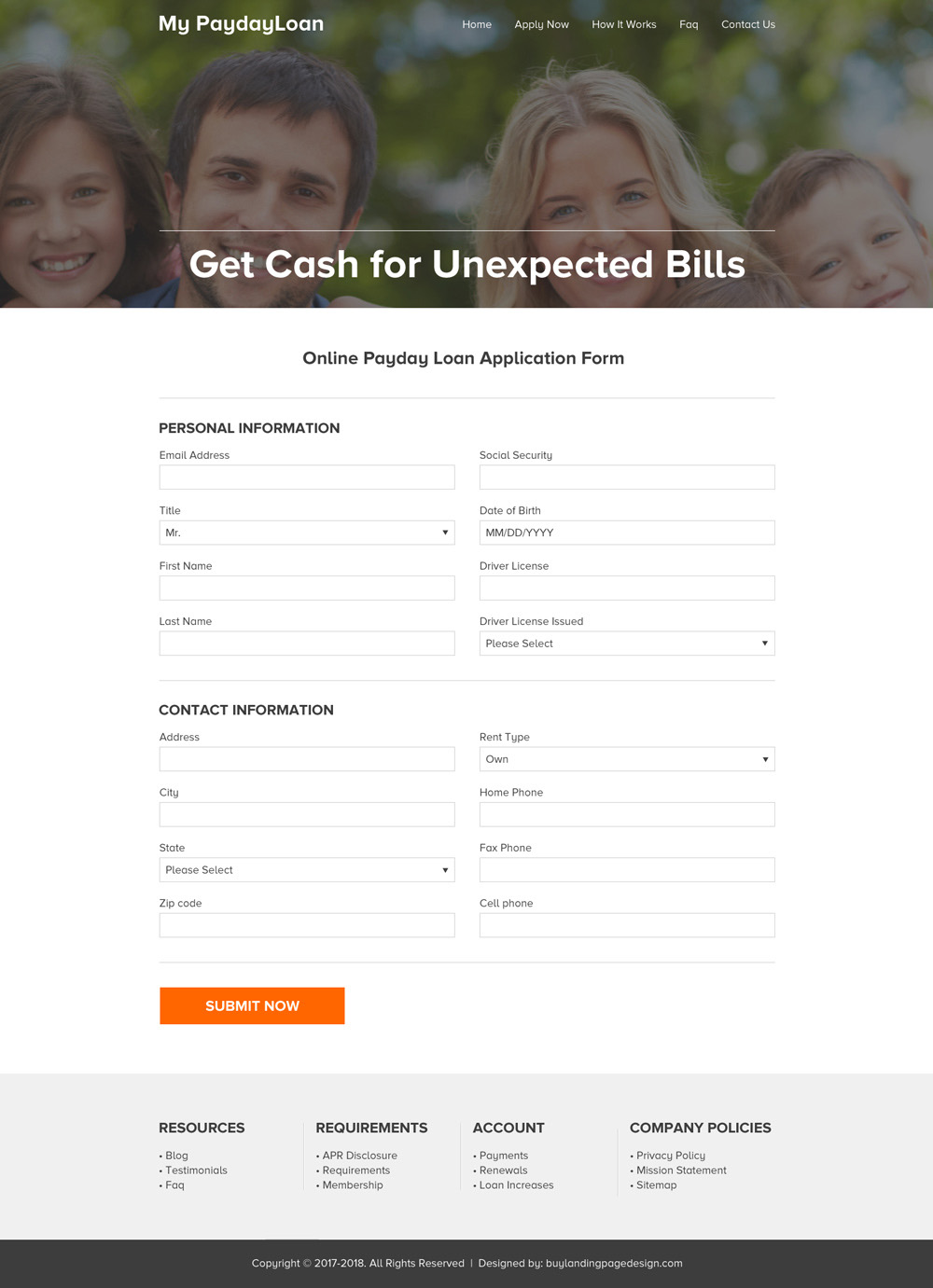

If you need to see the sorts of concerns that was asked for a beneficial pre-recognition, just click here here and you may walk-through our very own mortgage pre-acceptance app.

FAQs: Inquiries You could have Whenever Implementing:

- What exactly is your target and all of address contact information for the past 2 yrs?

- Are you operating by just who?

- How could you be paid off?

- Are you willing to pay otherwise get any child help otherwise alimony?

Your remedies for such inquiries assist Mortgage officials determine financial obligation-to-income rates by calculating how much month-to-month earnings capable use and then multiplying you to definitely amount times the mortgage facts greeting proportion. Chances are they often subtract all of your current joint monthly installments from the financing declaration, into the leftover amount as the financial matter otherwise homeloan payment that you are qualified for. Is an example of that it calculation actually in operation: