By Amanda Dodge

Step one when selecting a property is actually making certain your be eligible for home financing. Lenders will opinion your money and offer a quotation out of just how much he could be prepared to leave you.

Together with distribution your pay stubs, financial statements, or other models, you will additionally need to show the recent tax documents. Instead of these secret variations, you can’t prove to lenders that you will be a trustworthy people provide financing to help you.

Sadly, this makes to purchase a property more difficult throughout the tax year. If you want to get a home in the spring, you may need to scramble in order to file their fees before you can start and work out also offers toward property.

To acquire a house is also tricky when you have never filed taxation, are obligated to pay back fees, or simply just forgot on the subject from inside the earlier in the day ages. Do you purchase a home for people who haven’t filed taxes? It’s difficult but you’ll be able to.

Their fees act as decisive proof your own yearly money. If you’re a great paystub features just how much your generated last few days and you may will bring a snapshot of your income, your fees declaration your annual money.

It checklist out of the count your made away from for each and every workplace, that’s crucial if you have multiple services (you located numerous W2s) or you acquired 1099 price work and you can obtained W9s.

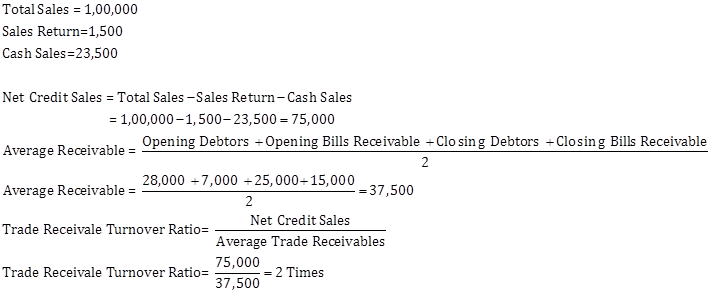

Mortgage brokers play with taxation statements inside their data to choose how much you can use. They use their said earnings as their reason behind calculating your debt-to-earnings proportion.

Most of the time, lenders require a debt-to-income proportion out of 36%. It indicates your expenses (as well as your homeloan payment) would not go beyond thirty six% of one’s month-to-month money.

Loan providers together with check your income tax records to determine how trustworthy youre. A debtor just http://paydayloanalabama.com/sylacauga/ who records their taxation annually is more credible than just a borrower who misses taxation repayments or forgets so you can file. Anyone helps make problems, it is therefore okay for those who required an extension in the one-point, however, know that your own lenders worry about your financial records.

Expenses your fees regularly and you can correctly can be as valuable to help you their financial given that to make monthly installments on the landlord.

Challenges of buying a property that have Unpaid Fees

There are two main style of outstanding fees to adopt: taxation you have not recorded but really and taxation you are behind for the.

If you are trying to buy a house in the spring, it’s likely that you haven’t paid your taxes from the previous year yet. You will need to work quickly to file as soon as you have your W2 otherwise W9 salary comments from your employer. The sooner you file your taxes, the sooner you can send the returns to your lender to buy a house.

Another situation is much more difficult. For those who owe taxes towards the Irs or have not registered more recent years, attempt to run a keen accountant otherwise income tax elite group to completely clean your finances. Here are some reasons why it is critical to shell out people delinquent taxation.

You will see a taxation Lien about Irs

A tax lien is a court claim regarding the government when you fail to pay your tax bill. This is tax debt that you owe the government. The underwriters your lender works with will notice any tax liens and make a note that you cannot pay your debt.

You should buy eliminate a taxation lien from the Internal revenue service if you are paying off the debt. The fresh agencies have a tendency to remove the income tax lien 1 month once you make payment, that allows that proceed into purchase process.