Article Advice

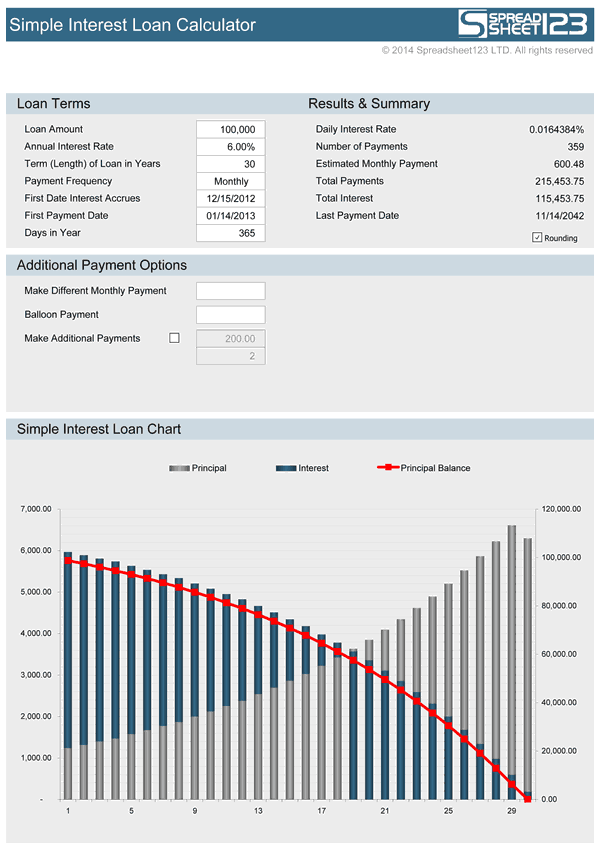

Your debt-to-earnings (DTI) proportion is how much money you have made instead of everything you spend. It’s determined of the separating their month-to-month expense by the disgusting monthly money. Essentially, it is preferable to help keep your DTI proportion lower than 43%, in the event 35% otherwise shorter is recognized as a.

- What exactly is good loans-to-income ratio?

- Debt-to-money proportion getting mortgage

- How exactly to assess your debt-to-earnings proportion

- Financial obligation so you can earnings proportion home loan calculator

- Can the debt-to-money proportion impression the borrowing from the bank?

- Just how the debt-to-money proportion affects you

- Simple tips to lower your obligations-to-income ratio

What exactly is a beneficial debt-to-income ratio?

In most cases away from flash, it’s best to has a debt-to-money proportion regarding only about 43% – typically, regardless if, a good DTI proportion was less than thirty five%. Your DTI ratio comprises of two-fold:

- Front-end proportion: Possibly called the newest construction ratio, the front side-prevent ratio means just what section of your income would go to houses will set you back. This consists of lease or home loan repayments, residents otherwise clients insurance rates and you can assets taxation.

- Back-end proportion: Which is the portion of your earnings that visits any month-to-month debt obligations, together with housing. This will shelter your car financing, credit cards and you may college student personal debt.

The DTI ratio support loan providers see whether you really can afford new personal debt. They performs a major part on the creditworthiness because lenders require to be certain you might be effective at installment.

Debt-to-money proportion out of thirty five% otherwise shorter

The reduced the DTI proportion, more definitely loan providers could possibly get view you as a possible debtor. Good DTI proportion which is lower than thirty five% means to help you lenders you have discounts and you may independency in your finances – it may also mean that you’ve got a good credit score, regardless of if this may not be your situation.

Debt-to-income proportion regarding thirty six% in order to forty-two%

For those who have a great DTI ratio anywhere between 36% and you will forty-two%, thus just like the newest level of financial obligation you really have is probable manageable, it may be best if you pay the debt. When you’re loan providers is ready to provide you with borrowing, a beneficial DTI proportion more than 43% get dissuade certain loan providers.

Debt-to-earnings ratio out of fifty% or more

If you have a beneficial DTI proportion that is https://elitecashadvance.com/loans/guaranteed-approval-10000-loans/ more fifty%, you happen to be in a number of financial hot water. It may be best if you look for selection particularly borrowing from the bank counseling to help you most useful control your debt. A credit counselor normally sign up you during the a personal debt government plan and you may run your creditors to reduce your own rates and month-to-month payments.

Debt-to-money ratio getting financial

Mortgage lenders pay extra attention on DTI proportion if it comes to to order or refinancing a house. It scrutinize each other their top-stop and you will straight back-avoid DTI ratios, that will refute your residence mortgage demand if you carry also much financial obligation compared with your earnings.

The user Monetary Coverage Agency (CFPB) suggests users cover its back-stop DTI ratio during the 43%; but not, cannot believe in that to be eligible for home financing. Loan providers try not to envision expenses for example members of the family cellular phone plans, car insurance getting a unique adolescent driver or one to expenses bill planned in a number of ages – end trying out a cost that may squeeze your financial budget.

DTI ratio requirements always are normally taken for 41% and you will fifty% depending on the mortgage system your submit an application for. The rules tend to be more rigorous when you are taking out fully a traditional loan instead of home financing backed by an authorities service, including a keen FHA financing from the Government Houses Management (FHA) or a great Virtual assistant mortgage throughout the U.S. Company of Experts Points (VA).