Is another way to consider it. Say your contrast an investment that pays 5% a-year which have the one that pays 5% monthly. Towards the basic month, the new APY means 5%, like new Annual percentage rate. But for another, the fresh new APY is actually 5.12%, showing the latest monthly compounding.

Because the an elizabeth interest to your a loan or financial device, lenders commonly emphasize more flattering count, for this reason the situation in the Coupons Operate out-of 1991 mandated both Annual percentage rate and you may APY revelation during the ads, contracts, and you will agreements. A lender commonly market a cost savings account’s APY inside the a large font and its involved Annual percentage rate from inside the an inferior one, while the the former enjoys a superficially large number. The exact opposite happens when the lending company acts as the financial institution and you may attempts to convince its borrowers that it is billing a low rates. A beneficial investment to possess evaluating each other Annual percentage rate and APY pricing with the a home loan was a mortgage calculator.

ple

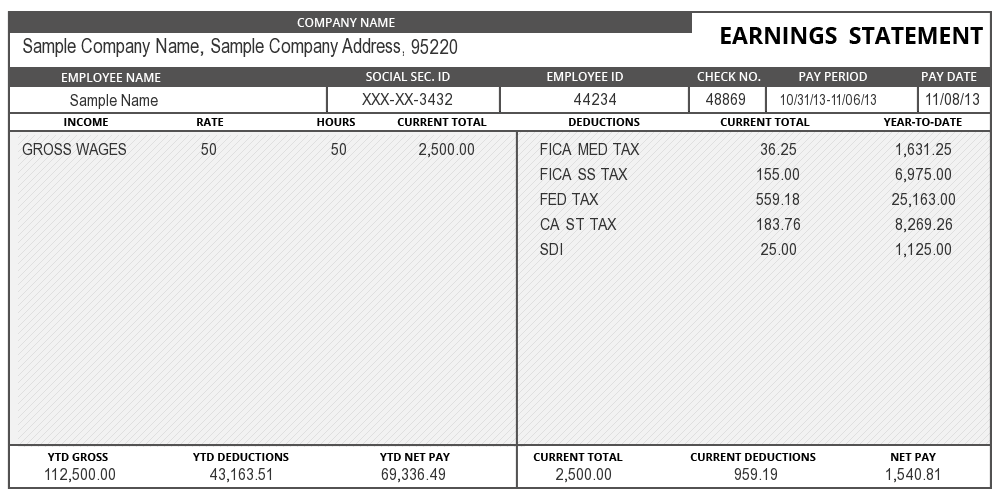

What if one XYZ Corp. now offers a charge card you to levies focus from 0.06273% day-after-day. Proliferate that from the 365, that will be 22.9% a-year, which is the reported Annual percentage rate. Now, if you were to costs a special $step one,000 items on card daily and you will waited through to the go out adopting the deadline (in the event that issuer become levying attract) to begin with making costs, you’d owe $1, for each and every issue you purchased.

So you can assess the fresh new APY or active yearly rate of interest-the greater number of normal term to own handmade cards-incorporate that (one signifies the principal) or take that number to your fuel of your own level of compounding episodes during the a year; subtract one from the lead to obtain the fee:

If you only bring an equilibrium on the credit card having one to month’s period, it’ll cost you the same yearly rates off twenty two.9%. But not, if you carry one to equilibrium to the season, your energetic rate of interest becomes twenty-five.7% right down to compounding each and every day.

An annual percentage rate tends to be higher than good loan’s nominal focus rate. This is because the fresh nominal rate of interest does not account fully for every other expenses accrued from the debtor. The affordable rate may be down on the mortgage if you dont make up settlement costs, insurance coverage, and you will origination costs. If you find yourself going these types of in the mortgage, your own mortgage harmony grows, once the does your own Annual percentage rate.

The brand new everyday unexpected rates, on top of that, is the notice recharged toward an effective loan’s balance on a regular basis-the Apr divided by the 365. Loan providers and you may credit card providers can represent Apr with the a monthly foundation, although, as long as an entire several-month Apr are noted somewhere through to the agreement is actually finalized.

Drawbacks of Apr (APR)

New Apr actually constantly an accurate meditation of your total price out of borrowing. Indeed, it could understate the real price of financing. That’s because brand new data guess much time-label repayment dates. The costs and you will costs are spread also slim that have Apr calculations to have loans Vincent money which can be reduced quicker or has actually faster installment periods. As an example, the average annual effect away from financial closing costs is a lot smaller whenever those individuals costs are believed having started spread-over 29 age unlike seven to a decade.

Exactly who Exercise Annual percentage rate?

Lenders has actually a fair level of authority to determine ideas on how to assess the brand new Apr, as well as or leaving out some other charge and you will costs.

Apr along with incurs specific challenge with variable-rate mortgage loans (ARMs). Prices always suppose a steady interest rate, and even though Annual percentage rate requires rate caps under consideration, the very last count continues to be based on repaired cost. As interest into an arm will change when the fixed-price period is more than, Annual percentage rate rates can also be really understate the actual borrowing from the bank will cost you when the mortgage costs increase in the long term.