Unlocking the best re-finance conditions

Refinancing the financial is like relationship-asking just the right inquiries upfront can save you a whole lot of trouble later on. Exactly as you would not invest in a relationship with no knowledge of the brand new maxims, diving on good re-finance without proper requests can cost you big-time.

Good and bad minutes in order to refinance

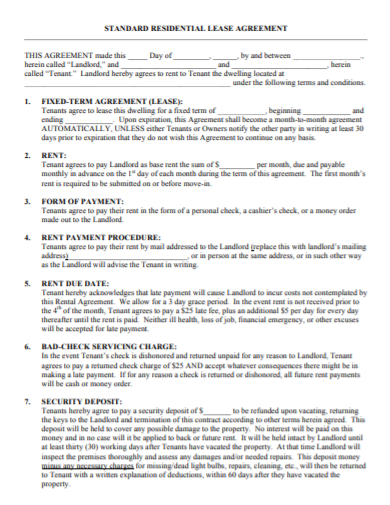

There are times – when financial prices are shedding prompt – whenever refinancing are a no-brainer. Bringing your speed is at the very least 0.5% below your current you to, refinancing is usually of good use.

And you may, of , mortgage rates was indeed on an obvious down pattern, however, there was in fact a lot of peaks and you can troughs along the way. Therefore, extremely people refinanced sporadically.

Source: Freddie Mac, 30-12 months Fixed Rate Mortgage Average in the united states, recovered of FRED, Government Reserve Bank out of St. Louis

However,, given that start of the 2021, up to this particular article is created, financial prices was basically on an ascending pattern. And fewer owners was in fact refinancing.

Federal national mortgage association reckons you to, within the few days finish , this new dollar amount of refinance apps are down 88.6% than the re-finance increase one to taken place when you look at the 3rd one-fourth out of 2020.

- To make a higher monthly payment

- Stretching-out the full time these are typically buying their home, usually incorporating significantly for the full amount their interest will cost all of them

Obviously, we aspire to understand the come back out of a dropping development when you look at the financial pricing; home owners could save plenty. Nevertheless hadn’t yet , turned up when this blog post is actually authored.

Whenever refinancing is good despite rising costs

Refinancings is rarer than they used to be but they usually have much away from disappeared. Some people nevertheless rating valuable advantages from all of them. Thus, what might men and women getting?

Really, periodically, a person who closely monitors home loan rates you’ll spot your latest mortgage price is 0.5% below the existing rates. Upcoming, they might would good rate-and-term re-finance, that will submit a lowered financial price instead of stretching the financing term.

Cash-aside refinances is a

However,, commonly, it is because anyone need a money-out re-finance. You replace your present home loan which have a much bigger one and you will walk out having a lump sum of your improvement, without closing costs.

Whenever you are refinancing so you can more substantial loan on a high rate, there are apparent downsides. You’re extremely likely to get a higher payment and you may the full price of credit to buy your home rockets.

That’s not specific. Like, in the event your credit rating is significantly large plus debt burden less than once you applied for your home loan, you will be provided a minimal price. However your monetary facts might have had to have turned to rating close to compensating for mortgage rates’ ascending trend.

You might be able to reasonable the effect on your month-to-month percentage (perhaps even rating a reduced that) by extending the full time you take to invest off your residence loan.

Such as for example, guess your 30-year financial has been going for twenty years. When you get a new 29-season mortgage, you are dispersed your instalments over half a century. Which can help along with your monthly premiums however, will send the fresh full matter you pay during the focus sky high.

Very, why re-finance? Because the often you prefer an earnings treatment so terribly that the (primarily deferred) discomfort is really worth it. Think you have crippling debts one to threaten every aspect of online payday loan Mentone AL your life, as well as your household. Or which you have come a different sort of dollars-eager providers. Otherwise you are instantly facing an inescapable and you will unplanned union.

Perhaps a profit-away re-finance can be your best way give. However,, before you decide on that, below are a few family equity financing and you will family security credit lines (HELOCs). With our next mortgage loans, your existing mortgage stays in place and you also spend a higher rates just in your this new credit.