As promised in our earlier in the day post , this article usually break apart the many benefits of this new Virtual assistant loan as compared to conventional loans. On the other hand, we are going to talk about some key points value considering whenever settling good loan. When the at any part you are not knowing from what you are entering, ask your real estate agent or financing administrator. They ought to be capable help you from the processes.

If you have ever bought an automobile before, you’ll be able to klnow in the off money. For having some type of managing demand for a beneficial property, really banks need you to feet some of the costs upwards front side. Antique home loans require a downpayment around 20% otherwise might charge you a supplementary payment titled PMI. The brand new Va financing doesn’t need any money down and you may do maybe not fees PMI.

Precisely what does that it do to you? State youre looking to financing a beneficial $100,000 domestic. Which have a traditional loan, would certainly be necessary to shell out $20,000 at the start otherwise shell out an additional commission with the bank should you standard. New Virtual assistant loan waives the brand new $20,000 needs and will not require you to shell out this percentage. This permits one to own a house and no money down, which is chances we aren’t getting.

Attractive Costs and you may Alternatives

Part of the Va financing is actually protected by the authorities and you are clearly allowed to shop around to have resource rather than being forced to use a singular source for your loan. So what does this suggest? This means loan agents are contending to suit your needs. When anyone is actually contending to suit your needs, you have made down rates. All the way down costs suggest you pay faster within the focus over time and you will make collateral of your home shorter. We’ll discuss just what which means afterwards.

For alternatives, the new Virtual assistant loan has several that can help you your bag afterwards. Earliest, there is the option to pre-shell out any time. Particular financing have pre-commission punishment. This simply means you are penalized getting repaying your loan very early. Va financing aren’t allowed to cost you for paying very early to help you repay your home as fast as might such as. Second, you should use the loan having property, condo, duplex, or freshly mainly based domestic. These choices allows you to possess options inside the where you live. 3rd, the Va loan are assumable. This simply means you to definitely normally you could transfer your loan to a different Va-eligible personal. While you are having problems attempting to sell your home, such as for example, you could transfer your loan to another Va-qualified individual. In the event that interest levels is actually rising, this could make installment loans Riverside IL it easier to notably.

Brand new Money Commission

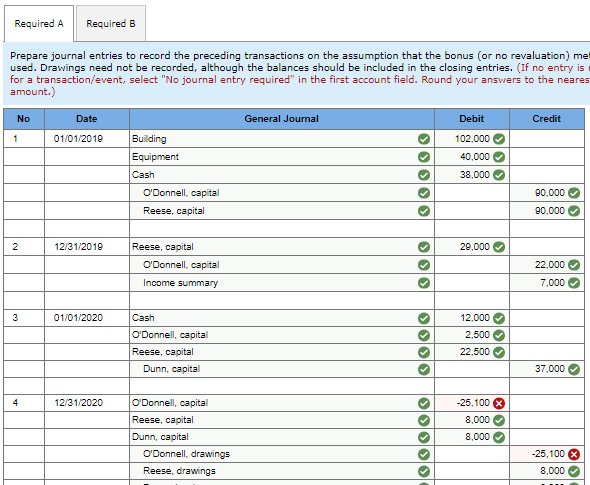

Brand new Virtual assistant loan really does need a funding fee that will help that have funding coming financing. In many cases, wounded pros and others might have that it fee waived. Check with your lender to possess eligibility. The fresh chart more than reveals the brand new capital fee needed while the a portion of your house price. Its a-one day commission to pay up side or financing as well. Going back to our very own earlier in the day example, if you buy a good $100,000 house with no cash down, the money commission was $dos,150 if this sounds like the initial household you’ve bought with your Virtual assistant financing.

Building Guarantee and you will financing options

Sorry for all of your own mundane dining tables! However, what exactly is found in such dining tables will probably be worth the looks. The newest dining table above will help you determine whether to have fun with a beneficial 15 or 31 seasons loan for how you will be building equity.

Your own monthly loan payment is made up of two parts, principal and you can focus. Prominent try currency going truly into control of the house. Appeal was money paid off with the lender to have funding the mortgage.

Your aim would be to build enough dominating and that means you ultimately very own your house downright. The brand new tables over let you know an effective $100,000 mortgage from the 4.5% attract. The top piece suggests a thirty year financial, the beds base portion shows good fifteen season mortgage. See the commission try highest to your 15 year home loan. This is because the mortgage is dispersed more than 15 years unlike 29. But not, more than a great 15 12 months home loan you have to pay faster notice therefore make prominent smaller. Spot the equilibrium throughout the much right column decrease faster to the 15 seasons mortgage.

BLUF: If you’re able to pay for a great 15 year home loan, you have to pay away from your home quicker while spend quicker attract.

When you’re interested in running the data your self, just click here. One area we did not speak about now try adjustable rates mortgage loans. We extremely counsel you will still be cautious about Hands. Any need for reading more about Possession, feel free to upload me an email. $