Lingering rising cost of living deceleration, a reducing economy plus geopolitical suspicion is also subscribe all the way down financial costs. At exactly the same time, investigation one to indicators upside chance to rising cost of living may result in highest pricing.

Benefits May help Add up of it All the

While you you will bore into all of stuff so you can most understand how it impression mortgage costs, that might be lots of work. And when you may be already busy planning a change, taking on anywhere near this much training and you may research may feel a small overwhelming. Unlike using your own time https://speedycashloan.net/personal-loans-nv/ thereon, lean to the professionals.

It coach people compliment of market requirements all round the day. They’re going to work at providing an instant post on any wider manner right up or down, exactly what positives state lays ahead, and just how all that affects you.

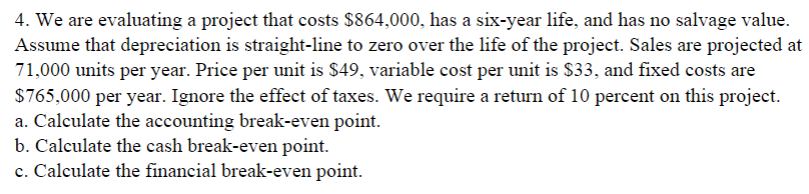

Grab which graph such as. It offers an idea of how financial rates impression your own monthly payment after you get a property. Consider being able to create a fees anywhere between $2,five hundred and you may $2,600 work with your finances (prominent and you will desire merely). The new eco-friendly part on the graph reveals payments in that range otherwise straight down based on different financial pricing (see graph below):

As you can tell, even a small shift within the pricing could affect the borrowed funds count you can afford when you need to stand within one to target finances.

It’s products and you may artwork such as these one grab everything that is going on and have just what it indeed opportinity for your. And simply a professional provides the education and you can expertise had a need to assist you as a consequence of all of them.

You don’t need to getting an expert for the home otherwise mortgage cost, you just need to has actually someone who are, by your side.

Bottom line

Enjoys questions regarding what’s happening throughout the housing marketplace? Let us hook up therefore we may take what are you doing right now and you may determine what it simply method for your.

Before making the choice to purchase a house, it is essential to policy for every will set you back you’ll end up in control to possess. While you are active rescuing into the deposit, remember you should prep to own closing costs too.

Preciselywhat are Settlement costs?

Closing costs will be the charges and you will expenditures you ought to pay just before becoming this new legal owner away from a property, condominium otherwise townhome . . . Settlement costs differ according to cost of the property as well as how it is getting funded . . .

To phrase it differently, your settlement costs may be the even more charges and you can repayments you may have and then make during the closure. Centered on Freddie Mac computer, while they can vary of the venue and disease, closing costs generally speaking become:

- Government recording will set you back

- Appraisal fees

- Credit report charge

- Lender origination charges

- Title & Escrow services

- Tax solution costs

- Survey charges

- Attorneys charges If you reside from inside the a lawyer condition or apply an attorney within the purchase

- Underwriting Fees

Exactly how much Try Settlement costs?

With regards to the exact same Freddie Mac post listed above, they might be typically ranging from dos% and you may 5% of full price of your house. With that in mind, here’s how you can get an idea of what you will want to finances.

What if the thing is property we would like to pick at the today’s average price of $384,five-hundred. According to the dos-5% Freddie Mac computer estimate, your own closure charges could well be between roughly $eight,690 and you will $19,225.

However, bear in mind, whenever you are searching for a property over otherwise below it price range, your own closing costs might be high or lower.

Make certain You might be Willing to Romantic

Since you initiate the homebuying travels, make sure to get a feeling of the costs involved from the advance payment so you can settlement costs.