I don’t know The way we Exercise, however, We Do’

Gran Buttigieg requires increasing the national services program who would allow it to be people to earn credit card debt relief, and then he desires to create societal college free for all the way down- and you can middle-income family so they really won’t need to obtain like a hefty share.

Sen. Kamala Harris, another best Democratic 2020 contender, recently established her own plan where reasonable-income pupils just who obtained Pell has on regulators could have to $20,000 of the loan financial obligation canceled when they launched and you may went a corporate within the a minimal-earnings people for a few many years.

Harris or any other individuals are also needing a boost in need-founded government gives and assistance to own Typically Black colored Colleges and universities, and additionally enabling every students in order to refinance the funds on down rates of interest.

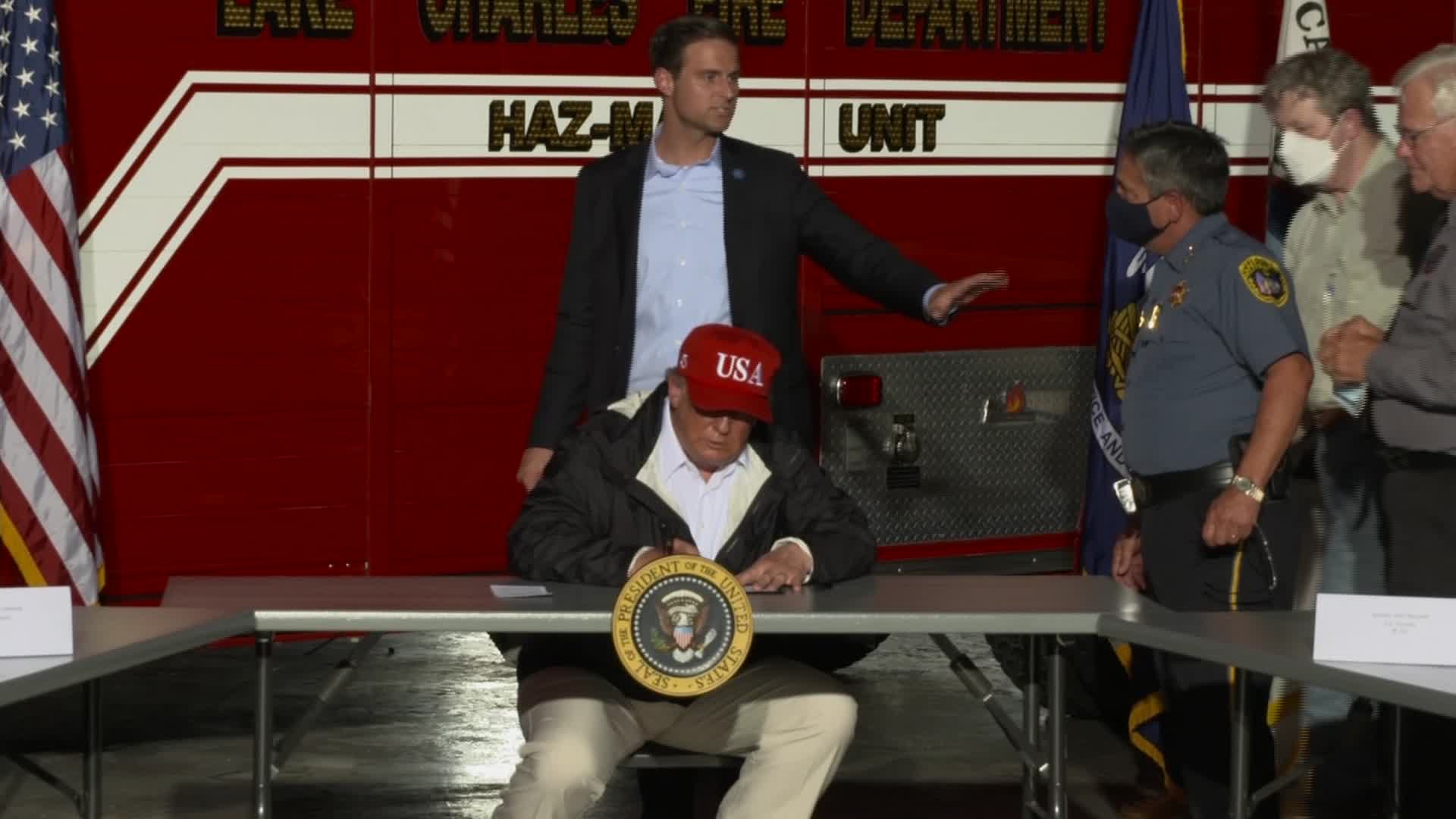

Possibly the White Household enjoys considered within the: Chairman Donald Trump’s 2020 funds proposal – essentially a signal from his concerns and you may positions – decrease anyone solution mortgage forgiveness program but called for an excellent a dozen.5 % limit with the monthly obligations and you may complete forgiveness immediately following 15 several years of payment to have undergraduate funds and three decades to own graduate school money. (więcej…)