When it is ordered having a ten% put the mortgage costs could have dropped because of the on the $97 weekly

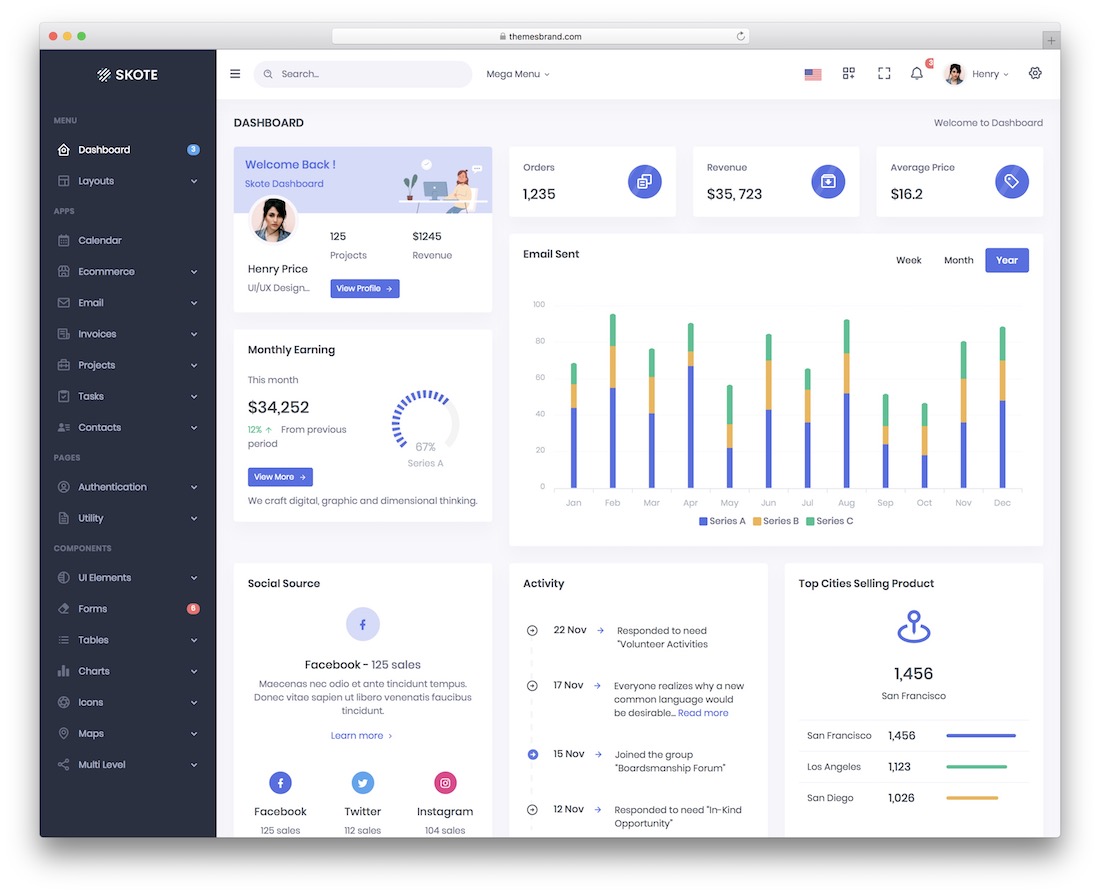

rates the borrowed funds repayments for the a house bought at the true Property Institute out of NZ’s national all the way down quartile cost will have declined from the as much as $81 per week anywhere between February and August this present year, whether your home was actually ordered having good 20% deposit.

That is because this new national straight down quartile speed declined away from $600,000 when you look at the February in order to $577,500 in the August, while the mediocre two year repaired financial price e period.

One to fortuitous combination not merely less the amount who would you prefer is purchased property within lower quartile rates, additionally faster the quantity you’ll need for a deposit, how big is the loan necessary to make buy and you may the amount of the loan repayments.

including measures up the loan costs outlined significantly more than, resistant to the median earnings from people old 25-31, locate a standard measure of value.

The brand new declines in cost and you may home loan rates means most of the countries of the nation are in reality considered sensible getting regular basic house buyers, considering they could abrasion to one another a 20% put.

That’s also genuine to your Auckland region, and therefore tucked according to the forty% cost endurance the very first time inside the nearly three years in the August.

The final date Auckland homes met the fresh affordability standards are , if the mediocre two year repaired mortgage price was only step 3.02%.

In fact the fresh new down moves within the cost and you will rates suggest really the only districts today sensed expensive to own regular first domestic people try Queenstown, and Rodney plus the North Shore inside the Auckland. (więcej…)